Financial institution of America has taken a serious step towards increasing regulated crypto publicity throughout conventional finance, permitting greater than 15,000 of its wealth advisers to advocate Bitcoin exchange-traded funds to purchasers for the primary time.

Confirmed in a press release shared with Yahoo Finance, the transfer marks a serious integration of Bitcoin merchandise into the banking sector to this point and signifies a rising urge for food for digital property amongst massive U.S. establishments.

BofA’s New Crypto Entry Marks Turning Level Forward of Potential Stablecoin Launch

Till now, Financial institution of America’s wealthiest purchasers might solely entry Bitcoin ETFs by immediately requesting them, leaving advisers unable to provoke any crypto-related suggestions.

Nevertheless, beginning January 5, purchasers of Merrill, Financial institution of America Non-public Financial institution, and Merrill Edge will achieve streamlined entry to 4 spot Bitcoin ETFs.

These embody the Bitwise Bitcoin ETF, Constancy’s Clever Origin Bitcoin Fund, Grayscale’s Bitcoin Mini Belief, and BlackRock’s iShares Bitcoin Belief.

The financial institution is pairing this entry with formal steerage that encourages purchasers to contemplate a small crypto allocation.

Financial institution of America’s chief funding officer, Chris Hyzy, stated purchasers with an curiosity in innovation and an understanding of market swings might think about a 1% to 4% allocation to digital property.

He famous that the decrease finish of the vary could also be appropriate for conservative buyers, whereas these with a better tolerance for portfolio swings might think about the higher finish.

Hyzy careworn that the financial institution’s steerage stays centered on regulated funding autos and knowledgeable decision-making.

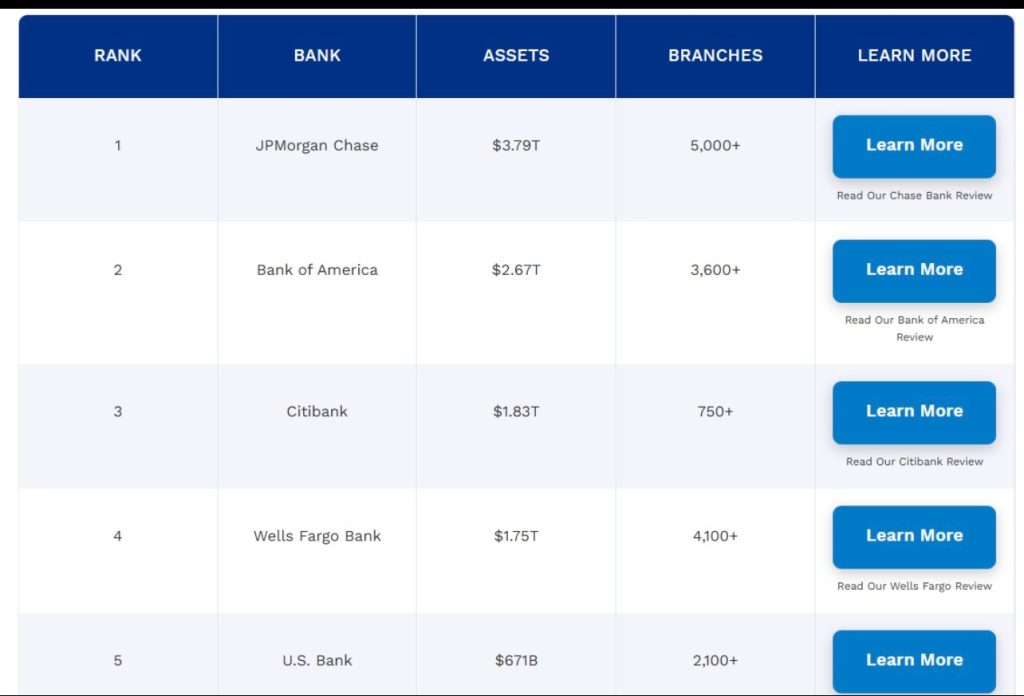

Financial institution of America, which holds roughly $2.67 trillion in consolidated property and operates greater than 3,600 branches, stated the shift displays rising demand from its shopper base.

The choice arrives as a number of different main U.S. monetary establishments transfer deeper into crypto markets.

Morgan Stanley, in October, steered that buyers think about a 2%–4% allocation to crypto.

Morgan Stanley’s International Funding Committee advises buyers to maintain a cautious 2%–4% of portfolios in crypto, tied to danger urge for food.#MorganStanley #CryptoPortfolio https://t.co/Y9lycldVbs

— Cryptonews.com (@cryptonews) October 6, 2025

In January, BlackRock instructed purchasers {that a} 1%–2% Bitcoin allocation falls inside an inexpensive vary, arguing that Bitcoin now carries a danger profile akin to main tech shares similar to Apple, Microsoft, Amazon, and Nvidia.

Constancy has additionally made the same advice, stating {that a} 2%–5% Bitcoin allocation might provide upside whereas managing draw back publicity.

Moreover, in June, Financial institution of America CEO Brian Moynihan stated the agency has accomplished substantial groundwork on launching its personal stablecoin, although the timeline will depend upon regulatory readability.

He added that the financial institution intends to satisfy buyer demand when circumstances enable.

Main Banks Deepen Crypto Push as Vanguard, Goldman, and JPMorgan Develop Companies

Past funding steerage, a number of main banks have accelerated their broader crypto plans.

Vanguard, after years of hesitation, has begun permitting prospects to commerce crypto-focused ETFs and mutual funds on its U.S. brokerage platform.

Vanguard will enable buying and selling of crypto-focused ETFs and mutual funds beginning Tuesday, opening entry to Bitcoin, Ether and different tokens for hundreds of thousands of buyers.#Vanguard #CryptoETFs https://t.co/mmU1DdIi7s

— Cryptonews.com (@cryptonews) December 2, 2025

Goldman Sachs just lately agreed to amass Innovator Capital Administration, including a set of defined-outcome ETFs, together with a Bitcoin-linked product, to its asset-management division.

JPMorgan Chase has ramped up crypto integrations as nicely, permitting prospects to fund Coinbase accounts utilizing Chase bank cards.

In the meantime, regulators in the US and overseas are shaping the surroundings through which these establishments will function.

The Workplace of the Comptroller of the Foreign money just lately confirmed that nationwide banks might maintain crypto on their stability sheets for actions similar to paying blockchain transaction charges.

U.S. banks formally cleared to carry crypto following the @USOCC coverage reversal, a serious win for digital property and conventional finance. #OCC #Bankshttps://t.co/PYpmuOPZmK

— Cryptonews.com (@cryptonews) November 19, 2025

Moreover, a rising shift amongst youthful buyers can be influencing this wave of institutional exercise.

A survey from crypto funds agency Zerohash discovered that 35% of younger, high-earning People have already moved cash away from advisers who don’t provide crypto publicity.

Greater than 80% stated their confidence in digital property elevated as main establishments adopted them.

The research additionally discovered sturdy demand for entry to a wider vary of digital property past Bitcoin and Ethereum.

The put up Financial institution of America Simply Unleashed Bitcoin ETFs to fifteen,000+ Advisers – Right here’s Why It Issues appeared first on Cryptonews.