The Ethereum Basis has set a brand new technical roadmap prioritizing safety over velocity for zero-knowledge Ethereum Digital Machines (zkEVMs), establishing three vital milestones stretching via the tip of 2026.

The shift comes after zkEVM groups efficiently decreased proving instances from 16 minutes to 16 seconds whereas reducing prices by 45 instances, with 99% of Ethereum blocks now provable in underneath 10 seconds on the right track {hardware}.

Regardless of these efficiency achievements, the inspiration warned that safety stays “the elephant within the room,” with many STARK-based zkEVMs counting on unproven mathematical conjectures that current analysis has begun to disprove.

“If an attacker can forge a proof, they’ll forge something: mint tokens from nothing, rewrite state, steal funds,” the inspiration said in a December 18 put up.

zkEVMs crushed the 2025 boss: real-time proving

2026 boss: 128-bit provable safety

New weblog put up on the following stage for Ethereum zkEVMs: three milestones, paving the trail to mainnet-grade L1 zkEVMs.https://t.co/mueR1JWW6c

Recreation on.— George Kadianakis (@asn_d6) December 19, 2025

Provable Safety Turns into Non-Negotiable Commonplace

The inspiration established 128-bit provable safety because the obligatory goal for mainnet-grade zkEVMs, aligning with requirements really helpful by cryptographic standardization our bodies.

The primary milestone requires zkEVM groups to combine their proof system parts with soundcalc, a newly created safety estimation instrument, by the tip of February 2026.

By Could 2026, groups should obtain 100-bit provable safety with closing proof sizes underneath 600 kilobytes whereas offering compact descriptions of their recursion structure.

The ultimate milestone requires 128-bit provable safety, with proof sizes restricted to 300 kilobytes, and formal safety arguments for recursion soundness by year-end 2026.

George Kadianakis from the EF cryptography group emphasised the strategic timing of securing zkEVM architectures earlier than they develop into shifting targets.

“As soon as groups have hit these targets and zkVM architectures stabilize, the formal verification work we’ve been investing in can attain its full potential,” he wrote.

Current cryptographic advances, together with compact polynomial dedication schemes like WHIR, methods akin to JaggedPCS, and well-structured recursion topologies, now make these formidable safety targets achievable.

The inspiration plans to publish detailed technical posts in January outlining proof system methods for reaching the safety and proof dimension necessities.

Basis Expands Institutional Adoption Push

Whereas tightening technical requirements, Ethereum has concurrently accelerated institutional outreach via its new “Ethereum for Establishments” portal launched in October.

The platform guides enterprises and monetary establishments constructing on Ethereum’s infrastructure, highlighting the community’s decade-long reliability with over 1.1 million validators and steady uptime.

The inspiration emphasised privacy-preserving applied sciences, together with zero-knowledge proofs, totally homomorphic encryption, and trusted execution environments, as important for compliant institutional functions.

“Privateness options are not theoretical — they’re stay and scaling in manufacturing,” the inspiration famous, pointing to tasks like Chainlink, RAILGUN, and Aztec Community.

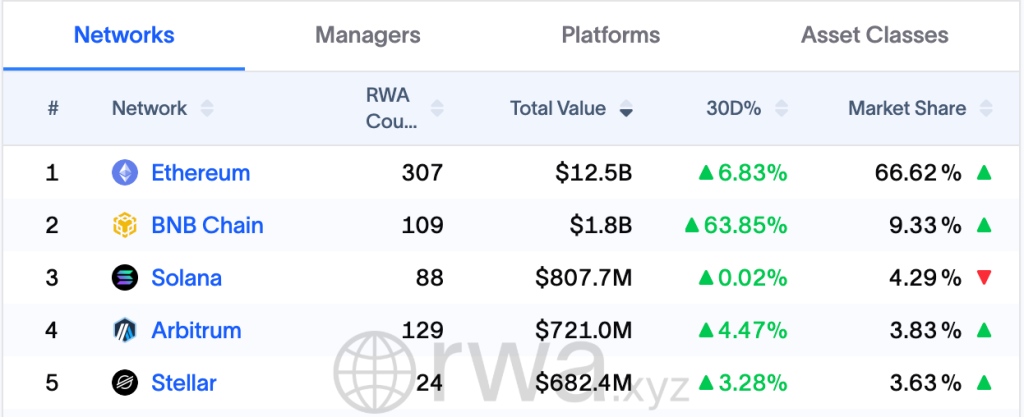

Ethereum at present hosts over 66% of all tokenized real-world belongings in line with RWA.xyz, with main monetary companies together with BlackRock, Securitize, and Ondo Finance deploying tokenized devices.

JPMorgan Chase lately launched its first tokenized money-market fund on Ethereum, seeding the MONY fund with $100 million and opening it to certified buyers with minimal investments of $1 million via its Kinexys Digital Property platform.

The financial institution’s asset administration head, John Donohue, advised the Wall Road Journal there may be “an enormous quantity of curiosity from purchasers round tokenization,” including that JPMorgan expects to steer the area with product choices that match conventional money-market funds on the blockchain.

Simplicity Problem Emerges as Important Precedence

A number of days in the past, Co-founder Vitalik Buterin recognized protocol complexity as a basic menace to Ethereum’s trustlessness in a December 18 assertion.

“An necessary and underrated type of trustlessness is rising the quantity of people that can truly perceive the entire protocol from prime to backside,” Buterin wrote, arguing the ecosystem ought to settle for fewer options if needed to enhance understanding.

@VitalikButerin says Ethereum’s trustlessness relies upon not simply on decentralization, however on how many individuals can perceive the protocol.#Ethereum #Buterinhttps://t.co/mIcGdixX8Z

— Cryptonews.com (@cryptonews) December 18, 2025

The priority resulted from the rising rigidity between superior performance and accessibility as Ethereum’s technical abstractions multiply.

“If solely 5 folks can perceive how your privateness protocol works, you haven’t achieved trustlessness, you’ve simply modified who you belief,” privacy-focused layer-2 community INTMAX said.

The inspiration acknowledged these challenges in its roadmap, describing Ethereum as “too complicated” for many customers whereas outlining plans for sensible contract wallets that simplify fuel charges and key administration.

In the meantime, the inspiration quickly paused open grant functions for its Ecosystem Help Program in August, citing plans to shift towards extra focused infrastructure funding after awarding almost $3 million to 105 tasks in 2024 alone.

The put up Ethereum Shifts Focus From Velocity to Safety With New 2026 Deadline appeared first on Cryptonews.

Leave a Reply