Arthur Hayes simply switched gears. The BitMEX co founder is now calling for a significant crypto rally, and he’s tying it to a $572 billion liquidity wave coming from Washington.

The set off? A Treasury shift involving the TGA and heavier buybacks. In easy phrases, additional cash flowing again into the system.

Hayes calls it financial morphine. And in his view, that shot of liquidity means the worst of the downturn is already behind us.

Key Takeaways

- The Thesis: A synchronized drawdown of the Treasury Common Account and debt buybacks will flood markets with money.

- The Numbers: Hayes calculates roughly $572 billion in web liquidity hitting the monetary system earlier than year-end.

- The Timeline: This injection creates a high-probability setting for a Bitcoin surge beginning now.

Why Is Hayes Calling This a Liquidity Occasion?

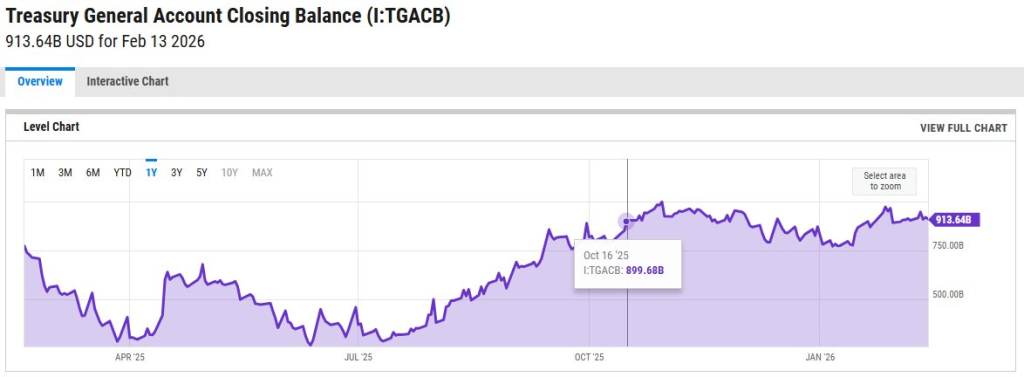

To get Hayes level, it’s a must to take a look at how the Treasury truly works. The Treasury Common Account is mainly the federal government checking account on the Fed. When that steadiness is excessive, money simply sits there. When it will get spent down, that cash flows into the banking system and boosts general liquidity.

Hayes says that is stealth stimulus. Whereas the Fed retains speaking robust about tightening, the Treasury is quietly pushing money again into circulation to stabilize the debt market. That hole between messaging and motion is the place he sees alternative.

In easy phrases, liquidity is being injected even when it’s not labeled as easing. And in markets pushed by flows, that issues greater than headlines. If the tap is open, threat property like Bitcoin have a tendency to reply.

Breaking Down the Numbers: The $1 Trillion Query

Hayes is just not being refined concerning the scale. The TGA steadiness is sitting close to $750 billion, whereas Treasury steerage factors to a goal nearer to $450 billion. That distinction alone implies roughly $301 billion flowing again into the system because the steadiness will get drawn down.

Then add the buybacks. The Treasury has began repurchasing older bonds to assist market functioning. Hayes estimates that program may inject one other $271 billion per yr on the present tempo. Put collectively, that’s about $572 billion in liquidity.

From his perspective, that form of circulation offsets a lot of the Federal Reserve quantitative tightening. It’s not labeled as easing, however the impact can really feel related. And when liquidity rises, threat property normally don’t stay quiet for lengthy.

What Does This Imply for Bitcoin Value?

Hayes is looking it plainly. In his view, the unhealthy part for crypto is behind us. Bitcoin has traditionally moved with world liquidity, and if {dollars} are increasing once more, that shifts the steadiness in BTC favor.

Extra provide of USD usually means stronger upside stress on scarce property.

Bitcoin (BTC)24h7d30d1yAll time

The setup is already tilted bullish. Funding charges have been excessive, hinting at a crowded quick commerce. If recent Treasury liquidity begins flowing whereas shorts are leaning the flawed approach, that mixture can flip into a quick squeeze. Hayes thinks that opens the door to a run again towards all time highs, even $100,000.

He isn’t alone in that stance. Huge gamers are quietly stepping again in, including publicity throughout dips. The message from Hayes is easy. When liquidity turns, markets transfer. And this time, he believes the transfer is up, not down.

Uncover: Listed here are the crypto prone to explode!

The put up Arthur Hayes Shares Two Situations for Bitcoin Value, Calling for a Main Crypto Rally appeared first on Cryptonews.

Leave a Reply