Billionaire Bitcoin advocate Michael Saylor’s firm Technique Inc. has elevated its U.S. greenback reserves by $748 million, bringing whole USD liquidity to $2.19 billion, in keeping with a regulatory submitting.

Technique has elevated its USD Reserve by $748 million and now holds $2.19 billion and ₿671,268. https://t.co/FDxIuJ8qZB

— Technique (@Technique) December 22, 2025

The replace additionally confirmed that the agency continues to carry 671,268 bitcoin reinforcing its long-standing Bitcoin-centric treasury technique.

ATM Program Raises $747.8M in Internet Proceeds

The rise in money reserves stems from gross sales carried out below Technique’s at-the-market (ATM) providing program. Through the interval from December 15 to December 21, the corporate stories it bought roughly 4.54 million shares of its Class A standard inventory (MSTR), producing internet proceeds of $747.8 million after gross sales commissions.

No most well-liked inventory gross sales have been recorded in the course of the week, regardless of a number of most well-liked share lessons remaining out there for issuance.

As of December 21, Technique reported over $41 billion in mixture capability remaining throughout its numerous widespread and most well-liked inventory ATM applications highlighting substantial monetary flexibility ought to the corporate select to boost further capital.

Bitcoin Holdings Stay Unchanged at 671,268 BTC

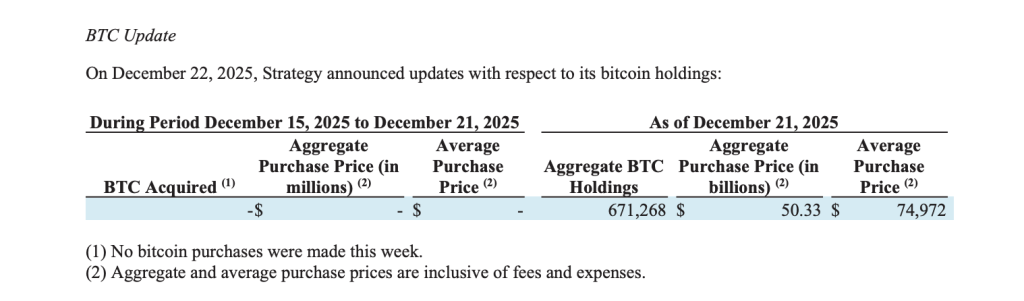

The submitting exhibits that Technique didn’t purchase any bitcoin in the course of the reported interval. Its mixture bitcoin holdings remained regular at 671,268 BTC as of December 21, with an mixture buy worth of roughly $50.33 billion.

The common buy worth throughout the corporate’s bitcoin holdings stood at $74,972 per bitcoin, inclusive of charges and bills.

Whereas the corporate has traditionally used fairness and debt issuances to fund bitcoin acquisitions the absence of purchases this week suggests a pause in accumulation amid market circumstances or a strategic determination to prioritize liquidity.

Liquidity Strengthens Stability Sheet Optionality

By lifting its USD reserves to $2.19 billion, Technique strengthens its stability sheet and near-term optionality. The money buffer supplies flexibility to service obligations, handle volatility or fund future bitcoin purchases with out instant reliance on capital markets.

The submitting doesn’t specify how or when the money will likely be deployed. Technique has persistently framed capital raises as a way to help long-term bitcoin accumulation whereas sustaining enough liquidity to navigate market cycles.

Capital Markets Exercise Reveals Lengthy-Time period Technique

The continued use of ATM applications exhibits Technique’s willingness to actively faucet fairness markets to bolster its capital construction. With no bitcoin purchases made in the course of the week. This newest replace suggests a tactical pause moderately than a shift in long-term technique.

Technique’s increasing money reserves alongside unchanged bitcoin holdings point out a twin give attention to balance-sheet resilience and readiness for future alternatives.

Bitcoin Slips Under $90K

Bitcoin has fallen beneath the $90,000 stage, extending a pullback from its latest peak close to $120,000 as traders grapple with unsure macroeconomic alerts and uneven liquidity circumstances.

As rates of interest keep elevated, the price of capital continues to weigh on speculative property. One analyst notes that Bitcoin tends to reply to forward-looking liquidity expectations, that means that with out clear conviction round a sustained easing cycle, institutional capital is more likely to stay selective or sidelined.

The publish Billionaire Michael Saylor’s Technique Boosts USD Reserves by $748M to $2.19B appeared first on Cryptonews.

Leave a Reply