After robust week, Binance nonetheless tightining its grip on crypto. The change now controls 65% of all stablecoin reserves sitting on centralized platforms.

Proper now, it holds about $47.5 billion in USDT and USDC alone. That may be a huge chunk of crypto liquidity parked in a single place.

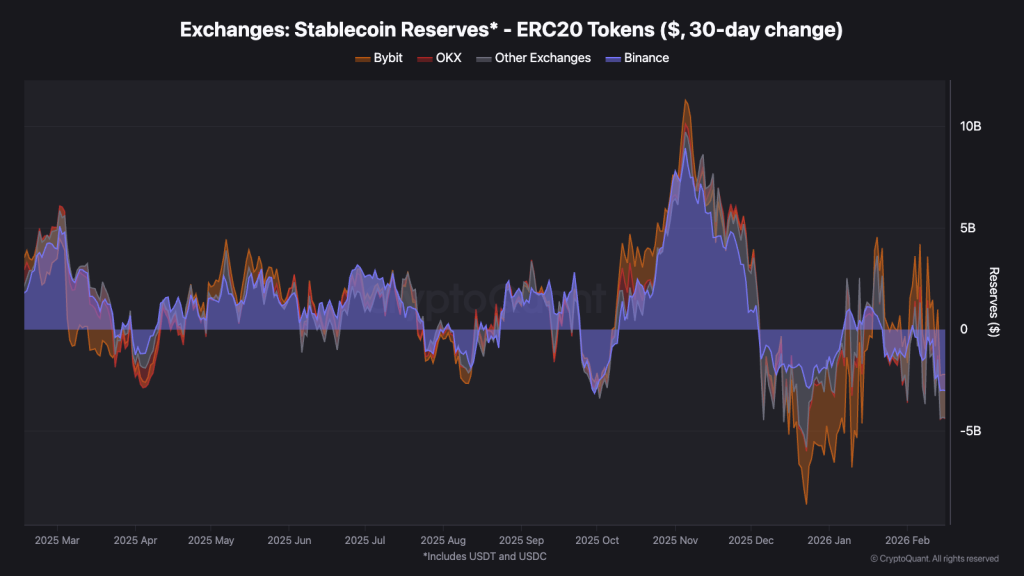

What makes it extra fascinating is the timing. Broader market outflows have cooled to round $2 billion. So whereas capital will not be flooding in aggressively, Binance is quietly tightening its grip on the stablecoin provide.

In crypto, liquidity is energy. And Binance is stacking a number of it.

Key Takeaways

- Dominant Market Share: Binance now holds $47.5 billion in stablecoins, representing 65% of all CEX liquidity.

- Outflows Stabilize: Month-to-month stablecoin outflows have slowed to $2 billion, a pointy drop from the $8.4 billion seen in late 2025.

- Rivals Path: Nearest rival OKX holds simply 13% of reserves, highlighting a widening hole in change liquidity depth.

Why is Capital Consolidating?

Cash will not be working away from crypto. It’s shifting to the place it feels most secure. On the peak of the late 2025 panic, redemptions hit $8.4 billion. Now outflows have cooled to round $2 billion this month. That shift suggests rotation, not abandonment.

As a substitute of exiting the ecosystem, traders look like consolidating round deeper liquidity and quicker execution. In tight circumstances, merchants care extra about slippage and reliability than spreading funds throughout smaller venues.

That’s the reason capital is clustering on the most important platforms. When uncertainty rises, perceived secure havens entice the majority of the circulation.

Binance Stablecoin Information Breakdown

The dimensions of Binance lead is difficult to disregard. Information reveals the change now holds about $47.5 billion in stablecoins, up from $35.9 billion a yr in the past.

That may be a 31% bounce in twelve months. The expansion adopted a transparent pivot after the BUSD wind down, with liquidity rotating closely into USDT and USDC.

In the meantime, rivals are far behind. OKX holds round $9.5 billion. Coinbase sits close to $5.9 billion. Bybit trails with roughly $4 billion. The hole will not be small. It’s structural.

Latest reserve experiences present Binance whole reserves, together with crypto property, above $155 billion. When liquidity shifts on Binance, it tends to ripple throughout the market. That’s how dominant its place has turn out to be.

The submit Binance Controls 65% of CEX Stablecoin Reserves – What It Means for Liquidity appeared first on Cryptonews.

Leave a Reply