Bitcoin is attempting to stabilise after a pointy $4,000 sell-off on December 17, buying and selling close to $87,000. The fast query for market contributors is simple: can BTC get better sufficient floor to reclaim $90,000 earlier than Christmas, or has the latest drop shifted momentum decisively decrease?

The timing issues. Markets are getting into a interval of thinner liquidity, and US CPI knowledge due at this time might decide whether or not danger urge for food stabilises or fades additional. With inflation expectations shaping interest-rate outlooks, Bitcoin is responding much less to crypto-specific developments and extra to macro alerts.

Sentiment Weakens as Threat Urge for food Fades

Investor positioning has turned defensive following final week’s decline. The Crypto Concern and Greed Index has fallen to 22, inserting sentiment firmly in concern territory. This displays diminished risk-taking relatively than compelled promoting, with merchants scaling again publicity whereas ready for clearer affirmation.

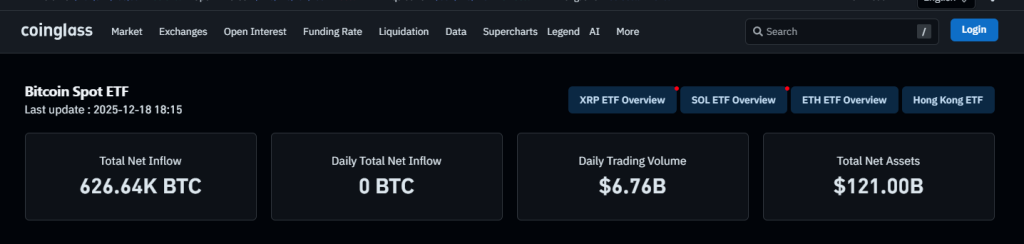

ETF exercise helps this view. US spot Bitcoin ETFs recorded a internet influx of roughly 5,210 BTC on December 17, based on CoinGlass knowledge. Nevertheless, inflows stalled in subsequent classes. Whereas cumulative internet inflows stay substantial at round 626,600 BTC, the shortage of constant every day additions factors to hesitation relatively than renewed demand.

Buying and selling exercise additionally stays contained. Day by day spot ETF buying and selling quantity stood close to $6.76 billion, with whole internet property holding near $121 billion, indicating stability however restricted urge for food for aggressive positioning.

Fundamentals Maintain, however Macro Units the Tempo; US CPI In Focus

Bitcoin’s longer-term fundamentals stay intact. Circulating provide stands close to 19.96 million BTC, persevering with its gradual transfer towards the fastened 21 million coin cap. Community safety stays steady, and whereas institutional exercise has slowed, there is no such thing as a signal of a broad exit from the market.

Within the close to time period, macro circumstances are driving value motion. Markets are centered on US CPI knowledge due at 13:30 UTC, which carries added weight after October’s report was cancelled and November knowledge had been partially incomplete as a result of federal authorities shutdown.

In response to the US Bureau of Labor Statistics, the newest full knowledge confirmed headline CPI at 3.0% yr on yr, with core inflation slowing to three.0%.

Consensus forecasts now level to headline CPI at 3.1% and core inflation at 3.0%, each above the Federal Reserve’s 2% goal.

With every day Bitcoin buying and selling quantity close to 44 billion {dollars}, participation seems regular however cautious. A stronger CPI studying might weigh on danger property, whereas a softer print could give Bitcoin room to stabilise.

Bear Flag Breakdown Retains Strain On

Technically, Bitcoin stays below strain. The every day chart confirms a bear flag breakdown, signaling continuation of the prior downtrend relatively than a pause. BTC is buying and selling under the 50-day EMA close to $94,500 and the 100-day EMA round $100,100, each of which proceed to cap upside makes an attempt.

Momentum indicators align with this view. The RSI within the low-40s exhibits persistent bearish strain with out reaching oversold ranges. Latest candles replicate weak follow-through on rallies, suggesting consumers are hesitant forward of macro danger.

Key assist sits within the $85,000–$84,000 zone. A every day shut under this space would expose $80,600. On the upside, Bitcoin must reclaim $90,200 decisively to problem the bearish construction.

Bitcoin Value Prediction Forward of Christmas

Within the close to time period, Bitcoin’s path hinges on US CPI and follow-through value motion. A transfer above $90,000 earlier than Christmas is feasible, but it surely probably requires a softer inflation print and a fast reclaim of damaged assist. With out that, rallies could battle and stay weak to promoting strain.

For now, Bitcoin seems caught between macro uncertainty and technical resistance. Whether or not the subsequent transfer is a restoration towards $96,800 or a deeper check towards $80,000 will rely much less on sentiment and extra on how markets digest inflation knowledge and danger heading into year-end.

Whereas Bitcoin reacts to macro strain, some buyers are additionally watching early-stage crypto initiatives nearing vital presale deadlines.

PEPENODE: A Mine-to-Earn Meme Coin Nearing Presale Shut

PEPENODE is gaining momentum as a next-generation meme coin that blends viral tradition with interactive gameplay. With over $2.36 mn raised and the presale approaching its cap, curiosity is constructing quick because the countdown enters its last stretch.

What makes PEPENODE stand out is its mine-to-earn digital ecosystem. As an alternative of passive holding, customers can construct digital server rooms utilizing Miner Nodes and services, incomes simulated rewards via a visible dashboard. The idea brings gamification and competitors into the meme coin area, giving holders one thing to do earlier than launch.

The undertaking additionally provides presale staking, permitting early contributors to earn boosted rewards forward of the token era occasion. Leaderboards and bonus incentives are deliberate post-launch to maintain engagement excessive.

With 1 $PEPENODE priced at $0.0012016 and restricted allocation remaining, the presale is getting into its last alternative window for early consumers.

Click on Right here to Take part within the Presale

The publish Bitcoin Value Prediction: Can the BTC Value Push Above $90,000 Earlier than Christmas After the $4K Dump on Dec.17? appeared first on Cryptonews.

Leave a Reply