Bitcoin surged again into focus after US inflation knowledge eased fears of persistent worth pressures, reigniting demand for threat property and pushing BTC firmly above the $95,000 mark. With CPI confirming cooling inflation and technical buildings flipping bullish, Bitcoin seems much less like a speculative rebound and extra like a continuation of a broader institutional-led pattern.

Core CPI at 2.6% Lifts Bitcoin Towards $95,000

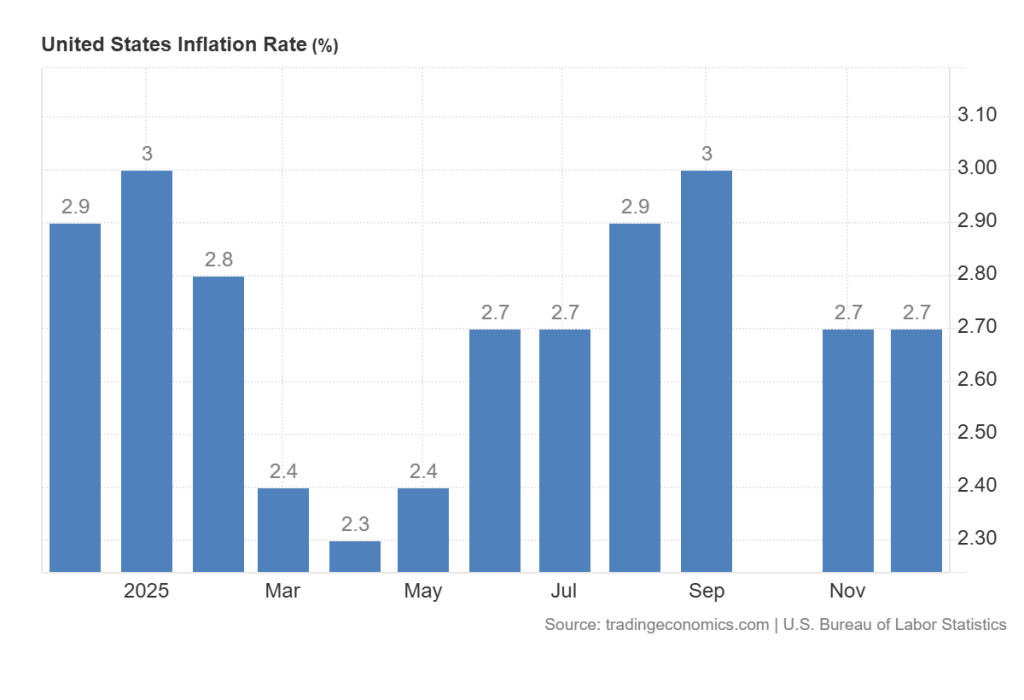

Bitcoin is buying and selling close to the $95,000 stage after gaining greater than 3% over the previous 24 hours, supported by softer inflation knowledge and a modest pullback within the US greenback. The most recent US Shopper Worth Index report confirmed headline inflation holding regular at 2.7% yr over yr in December, consistent with market expectations, whereas core inflation remained unchanged at 2.6%, its lowest stage since 2021.

On a month-to-month foundation, CPI rose 0.3%, matching forecasts, with shelter prices accounting for a lot of the rise. Power costs climbed 2.3%, whereas meals costs rose 3.1%, underscoring that worth pressures stay uneven fairly than accelerating broadly. Crucially for markets, the absence of an upside shock in core inflation eased issues that the Federal Reserve could must preserve financial coverage restrictive for longer.

For Bitcoin, this setting issues. Steady inflation and a contained core studying scale back strain on Treasury yields and the US greenback, permitting capital to rotate towards various shops of worth. With actual yields stabilizing, Bitcoin benefited alongside broader threat property.

Japan’s finance minister and US Treasury Secretary Scott Bessent shared issues in regards to the weakening yen throughout a bilateral assembly because the forex edged towards a key threshold the place authorities have intervened prior to now https://t.co/el2QVQwBT1

— Bloomberg (@enterprise) January 13, 2026

Forex markets echoed this shift. The Japanese yen slid to multi-month lows, whereas the euro and British pound traded with restricted follow-through, highlighting continued unease round world financial and monetary situations.

In opposition to this panorama of fiat uncertainty and moderating US inflation, Bitcoin’s function as a policy-insensitive asset gained renewed consideration from each institutional and macro-focused traders.

Fitch Warns on BTC-Backed Securities Threat

Fitch Scores just lately cautioned that Bitcoin-backed debt devices carry elevated threat as a consequence of BTC’s worth volatility, significantly the place leverage and collateralized lending are concerned. Crucially, the company excluded spot BTC ETFs from this warning, noting that broader ETF adoption may assist dampen long-term volatility fairly than improve it.

Fitch Scores warns of the dangers of Bitcoin-backed securities

Fitch Scores, one of many main score companies, has warned that Bitcoin-backed securities carry excessive dangers and speculative credit score profiles.

The inherent volatility of BTC costs can shortly erode the worth of… pic.twitter.com/B4kDhYp2kC— Atlas21 (@Atlas21_eng) January 13, 2026

That distinction is important for institutional traders. Publicity to Bitcoin is more and more shifting towards regulated, clear buildings as a substitute of speculative credit score merchandise. A transparent instance is the launch of 21Shares’ Bitcoin Gold ETP (BOLD) on the London Inventory Trade, which allocates roughly two-thirds to gold and one-third to Bitcoin, positioning BTC alongside a standard safe-haven asset

Collectively, increasing spot ETF entry and hybrid merchandise are reinforcing Bitcoin’s institutional enchantment whereas lowering dependence on leverage-driven crypto credit score fashions.

BTC and Gold Converge as 21Shares Launches BOLD ETP within the UK

21Shares has launched its Bitcoin Gold ETP (BOLD) on the London Inventory Trade, giving UK traders entry to a regulated product that mixes gold and Bitcoin in a single construction. The fund allocates roughly two-thirds to gold and one-third to Bitcoin and trades in each US {dollars} (BOLU) and British kilos (BOLD).

Disclaimer: Don’t make investments until you’re ready to lose all the cash you make investments. It is a high-risk funding and you shouldn’t count on to be protected if one thing goes mistaken. Take 2 minutes to be taught extra: https://t.co/d9gFbwImMu

Introducing the 21shares Bitcoin Gold ETP… pic.twitter.com/neRbphESOr

— 21shares (@21shares) January 13, 2026

BOLD is absolutely bodily backed, holding actual gold and Bitcoin, and was developed in partnership with ByteTree Asset Administration. By pairing gold’s long-standing function as a secure haven with Bitcoin’s rising fame as “digital gold,” the product targets inflation safety and macro volatility.

The itemizing strengthens Bitcoin’s institutional credibility and helps long-term demand by way of regulated funding channels.

Bitcoin (BTC/USD) Technical Outlook: BTC Breaks Symmetrical Triangle as $95,000 Turns Into Assist

From a technical standpoint, Bitcoin worth prediction appears bullish as BTC’s construction has turned decisively constructive. On the 2-hour chart, BTC has damaged cleanly above a long-developing symmetrical triangle that constrained worth motion by way of early January. The breakout adopted a transparent sequence of upper lows urgent in opposition to descending resistance, a basic setup for directional growth.

Former resistance between $94,500 and $95,000 has now flipped into assist, making a agency demand zone bolstered by shallow pullbacks and tight-bodied candles. The main indicator, RSI, stays elevated close to the upper-60s with out exhibiting bearish divergence, indicating momentum is robust however not overstretched.

If Bitcoin holds above $95,000, the technical roadmap factors towards:

- Preliminary resistance close to $97,600

- A better extension towards $98,800–$99,000

A pullback towards $95,000–$94,500 would possible be seen as constructive, with draw back threat contained beneath $93,000. So long as BTC stays above damaged triangle resistance, the broader pattern favors continuation, retaining optimism alive for the subsequent leg larger.

Bitcoin Hyper: The Subsequent Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is bringing a brand new part to the Bitcoin ecosystem. Whereas BTC stays the gold normal for safety, Bitcoin Hyper provides what it at all times lacked: Solana-level pace. The end result: lightning-fast, low-cost sensible contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Seek the advice of, the undertaking emphasizes belief and scalability as adoption builds. And momentum is already robust. The presale has surpassed $30.4 million, with tokens priced at simply $0.013575 earlier than the subsequent improve.

As Bitcoin exercise climbs and demand for environment friendly BTC-based apps rises, Bitcoin Hyper stands out because the bridge uniting two of crypto’s greatest ecosystems. If Bitcoin constructed the inspiration, Bitcoin Hyper may make it quick, versatile, and enjoyable once more.

Click on Right here to Take part within the Presale

The put up Bitcoin Worth Prediction: CPI Shock Sends BTC Flying – Is Wall Road About to Go All-In Once more? appeared first on Cryptonews.

Leave a Reply