Cathie Wooden is again buying. ARK Make investments simply picked up 41,453 shares of Coinbase inventory, value about $6.9 million.

What makes it fascinating is the timing. Simply weeks in the past, ARK was trimming publicity. Now they’re stepping again in as COIN tries to stabilize.

Key Takeaways

- The Purchase: ARK bought 41,453 shares value $6.9 million throughout three ETFs on Feb. 18.

- The Cut up: The bulk went to the flagship Innovation ETF (ARKK), which took 29,689 shares ($4.9 million).

- The Pivot: This reverses a promoting streak from early February the place ARK offloaded $17.4 million in COIN.

Is This a Tactical Pivot?

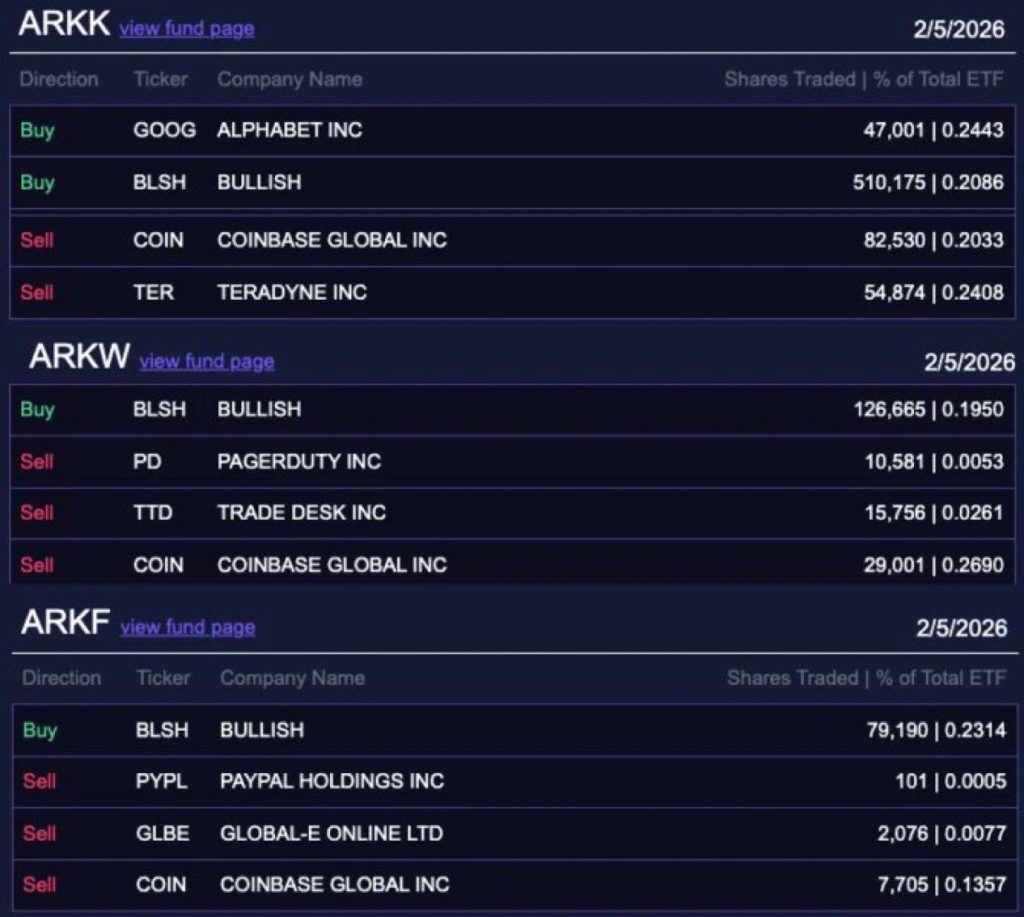

Just some weeks in the past, ARK was heading the opposite approach. The agency dumped about $17.4 million value of COIN on Feb. 5 and Feb. 6 whereas the broader market was sliding. On the similar time, it rotated capital into the crypto trade Bullish.

Now the script has flipped. That contemporary $6.9 million purchase suggests ARK sees worth at these ranges. It seems just like the traditional purchase the dip play they’re identified for.

For merchants watching ETF flows, this issues. ARK normally caps positions round 10% of a fund. The sooner promoting and newest add seemingly replicate portfolio balancing, not panic. It feels extra like weight administration than a change in long run conviction.

Why ARK Simply Purchased $6.9M in Coinbase Inventory

The buildup was unfold throughout three key funds. The flagship ARK Innovation ETF (ARKK) led the cost with a $4.9 million allocation. The Subsequent Era Web ETF (ARKW) added $1.2 million, whereas the Fintech Innovation ETF (ARKF) picked up $704,000.

This shopping for exercise occurred as COIN rebounded. Shares closed up 1% Tuesday at $166.02 and have gained 8.4% over the past 5 buying and selling days. Technically, the inventory is looking for help after falling 28% year-to-date.

Market observers word that such buying typically precedes potential rallies. Related technical alerts are flashing elsewhere out there, with some analysts warning of utmost funding charges that might set off squeeze eventualities.

In response to the agency’s disclosures, COIN stays a heavyweight within the portfolio. It’s the seventh-largest holding in ARKK (4% weighting) and the third-largest in ARKF (5.6% weighting).

What Does This Sign for COIN Inventory?

ARK’s return to the purchase aspect suggests confidence regardless of Coinbase’s combined earnings. The corporate lately reported a $667 million web loss for This autumn, pushed largely by unrealized crypto losses.

Nevertheless, analysts stay bullish. Bernstein maintained an outperform ranking with a $440 worth goal—implying over 200% upside. This optimism is partly fueled by expectations that historic capital inflows may increase retail buying and selling quantity within the coming months.

Regulatory readability additionally looms massive. With discussions heating up in Washington, particularly concerning upcoming market construction payments, the elemental case for Coinbase may shift quickly. For now, Cathie Wooden is betting that the present worth is a reduction, not a misery sign.

Uncover: Listed here are the crypto prone to explode!

The publish Cathie Wooden Reverses Course, Buys $6.9M in Coinbase Inventory – Is ARK Betting on a Rebound? appeared first on Cryptonews.

Leave a Reply