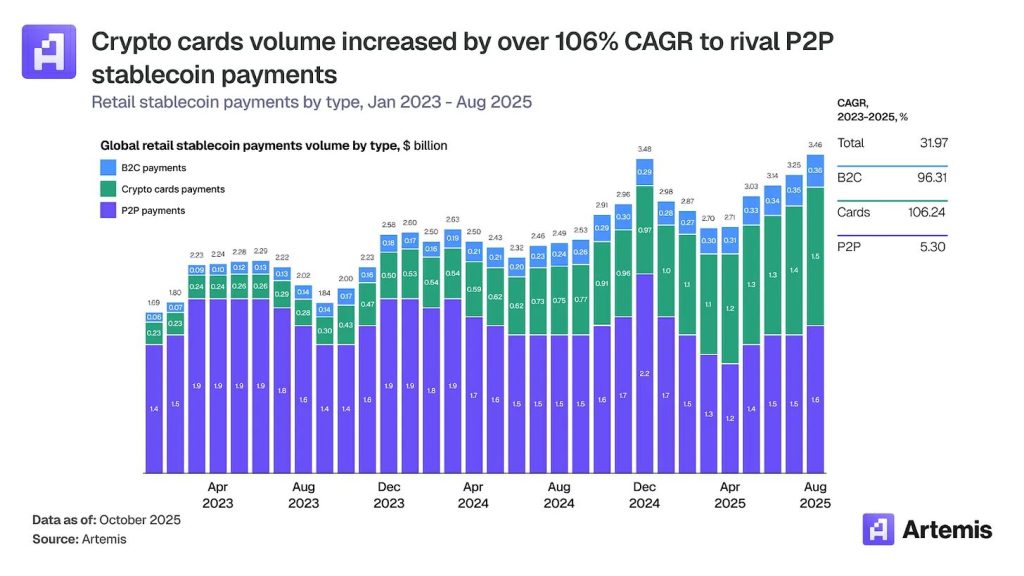

The crypto funds panorama has undergone a dramatic transformation, with crypto card volumes surging from roughly $100 million month-to-month in early 2023 to over $1.5 billion by late 2025, representing a 106% compound annual development price that now rivals peer-to-peer stablecoin transfers, based on a complete report from Artemis Analytics.

The explosive development positions crypto playing cards as the first bridge between digital property and on a regular basis commerce, with annualized volumes exceeding $18 billion whereas conventional P2P transfers grew simply 5% to $19 billion over the identical interval.

Visa has emerged because the dominant drive in crypto card infrastructure, capturing over 90% of on-chain card quantity by means of early partnerships with rising program managers and full-stack issuers.

Artemis famous that the cost big’s technique of participating infrastructure suppliers like Rain and Reap has confirmed extra scalable than Mastercard’s strategy of direct trade partnerships.

Full-Stack Issuers Reshape Card Economics

The crypto card infrastructure spans three vital layers (cost networks, card-issuing platforms, and consumer-facing merchandise), with essentially the most vital improvement being the emergence of full-stack issuers holding direct Visa principal membership.

Firms like Rain and Reap have collapsed conventional card issuance dependencies by combining BIN sponsorship, lender-of-record standing, and direct Visa community settlement into single platforms, capturing economics beforehand distributed throughout a number of intermediaries.

Visa’s stablecoin-linked card spend reached a $3.5 billion annualized run price in This autumn fiscal 2025, marking 460% year-over-year development, although nonetheless representing roughly 19% of whole crypto card settlement quantity.

Centralized exchanges deploy playing cards as user-acquisition funnels, with platforms like Gemini absorbing ongoing losses from bank card applications to drive platform engagement.

DeFi protocols akin to Ether.fi provide structurally greater cashback by means of token rewards, delivering roughly 4.08% returns whereas driving protocol TVL by means of collateralized borrowing options.

Geographic Alternatives Focus The place Stablecoins Remedy Actual Issues

Notably, India and Argentina stand out as world outliers the place USDC approaches parity with USDT in market share, presenting vastly totally different alternatives for crypto card adoption.

India recorded $338 billion in crypto inflows over the 12 months ending June 2025, but harsh tax insurance policies pushed most exercise offshore, creating large latent demand for compliant crypto merchandise constrained by regulatory friction quite than person curiosity.

Argentina’s alternative facilities on stablecoin debit playing cards for inflation hedging, the place no competing digital rail exists, whereas India’s potential lies in crypto-backed bank cards, on condition that UPI has already commoditized debit performance.

Nonetheless, Artemis famous that in developed markets, the chance lies in capturing a differentiated, high-value person section with larger monetary sophistication and rising digital asset balances, quite than fixing unmet cost wants.

For example, the mature U.S. bank card market. Regardless of bank card revenues rising considerably throughout issuers, a brand new section is rising.

Shoppers at the moment are holding significant stablecoin balances who more and more anticipate seamless spending capabilities, creating alternatives for conventional issuers who mix scale benefits with stablecoin-native capabilities earlier than crypto-native opponents solidify person relationships.

Playing cards Stay Strategic Regardless of Native Acceptance Push

Whereas main networks, together with Visa, Mastercard, PayPal, and Stripe, are constructing stablecoin-native service provider acceptance architectures, three structural realities recommend that crypto playing cards will preserve strategic relevance.

Artemis famous that community results spanning 150 million service provider places globally stay exceptionally troublesome to copy, requiring years of coordinated infrastructure funding that stablecoin-native techniques should rebuild from near-zero service provider protection.

Card networks bundle companies shoppers anticipate, akin to fraud safety, dispute decision, unsecured credit score, rewards applications, and buy protections, which stablecoin funds can’t simply replicate.

Notably, earlier this month, Anthony Yim, co-founder of Artemis, famous that DeFi merchants want USDC as a result of it “regularly transfer out and in of positions,” whereas broader adoption displays an “unstable geopolitical panorama” driving demand for the digital greenback.

International stablecoin transaction worth totaled $33 trillion in 2025, up 72% year-over-year, with Bloomberg Intelligence projecting $56 trillion by 2030.

Revolut’s stablecoin cost volumes alone surged 156% to roughly $10.5 billion, with on a regular basis transactions between $100 and $500 accounting for 30% to 40% of platform exercise.

Regardless of surging adoption, main banks have escalated resistance to yield-bearing stablecoins, warning they may drain trillions from conventional deposits.

Financial institution of America CEO Brian Moynihan has warned that stablecoins may pull trillions of {dollars} out of the US banking system.#Stablecoins #Cryptohttps://t.co/TTQ8cqCSm6

— Cryptonews.com (@cryptonews) January 15, 2026

Financial institution of America CEO Brian Moynihan cautioned that as much as $6 trillion may migrate into stablecoins, whereas JPMorgan’s Jeremy Barnum warned towards “the creation of a parallel banking system” with out prudential safeguards.

The pushback contributed to the Senate Banking Committee suspending its deliberate markup of a sweeping crypto market construction invoice after Coinbase withdrew assist, with Chairman Tim Scott citing ongoing bipartisan negotiations over provisions that might prohibit stablecoin yield funds.

The publish Crypto Card Market Explodes 15x as Stablecoin Spending Soars 106% Yearly: Report appeared first on Cryptonews.

Leave a Reply