With the rising availability of digital property in TradFi markets, institutional consideration has targeting ETH in a testomony to bullish Ethereum value predictions.

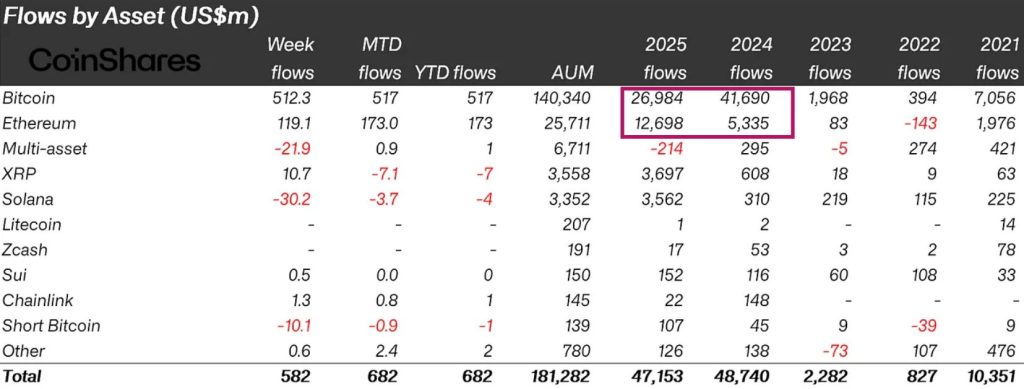

Capital flows present a transparent shift away from Bitcoin dominance. In 2025, Bitcoin inflows dropped 35% year-over-year to $26.98 billion, whereas main altcoins attracted sharply larger allocations.

Ethereum has led that push, recording a 137% improve with $12.69 billion.

Decentralized finance is often the core driver that separates Bitcoin from main smart-contract ecosystems, but DeFi exercise itself stalled by a lot of 2025.

Whole worth locked throughout DeFi protocols surged 121% in 2024, from $52 billion to $115 billion, however grew simply 1.73% the next yr to round $117 billion.

What makes this cycle completely different is the supply of demand. Quite than natural DeFi utilization, institutional participation has taken the lead.

The ETF narrative has broadened regulated digital asset publicity in U.S. TradFi markets, creating institutional-grade demand with a transparent choice for ETH.

Ethereum Worth Predicition: Why Are Establishments Bullish on ETH?

This capital rotation might have additionally been strategic, with Ethereum reaching the underside of a possible 20-month bullish head-and-shoulders breakout over 2025.

The Ethereum value has confirmed a neighborhood backside at $2,750, forming larger lows in a recent uptrend that solidifies the best shoulder.

Momentum indicators add validity to the development. The RSI is urgent towards the 50 impartial line after a number of larger lows, suggesting power beneath the floor.

The MACD has additionally reversed in direction of the sign line in a possible golden cross setup, an indication that consumers might quickly management the prevailing development.

A completely realised sample breakout might see the neckline examined round $5,500, reclaiming previous all-time highs and getting into new value discovery in a 75% transfer.

However because the bull market matures, broader institutional participation alongside traction in DeFi as mainstream use instances are realised might prolong the transfer 225% to $10,000.

Merchants ought to watch historic psychological ranges round $3,500 and $4000 all-time highs as interim resistance to the transfer.

Bitcoin Hyper: Solana Expertise Being Used for Bitcoin

Establishments that selected Ethereum as their TradFi guess might quickly have to rethink, because the Bitcoin ecosystem lastly tackles its greatest limitation: scalability.

Bitcoin Hyper ($HYPER) is bridging Bitcoin’s safety with Solana tech, creating a brand new Layer-2 community that unlocks scalable, environment friendly use instances Bitcoin couldn’t help by itself.

Simply as Layer-2s like Ondo did for Ethereum, Bitcoin Hyper might deliver Bitcoin deeper into the DeFi dialog.

The challenge has already raised over $30 million in presale, and post-launch, even a small fraction of Bitcoin’s large buying and selling quantity might ship $HYPER considerably larger.

Bitcoin Hyper is fixing the sluggish transactions, excessive charges, and restricted programmability which have lengthy capped Bitcoin’s potential – simply because the market turns bullish.

Go to the Official Bitcoin Hyper Web site Right here

The put up Ethereum Worth Prediction: Huge Cash Is Leaving Bitcoin – Are Establishments Quietly Flipping Bullish on ETH? appeared first on Cryptonews.

Leave a Reply