SoFi has change into the primary U.S. nationally chartered retail financial institution to difficulty a dollar-backed stablecoin on a public, permissionless blockchain, marking a turning level in how regulated banks take part in on-chain finance.

The way forward for on-chain settlement is right here.

Right now we launched SoFiUSD, a totally reserved #stablecoin issued by SoFi Financial institution, N.A., positioning us as a stablecoin infrastructure supplier for different banks, fintechs, and enterprise platforms.

We’re the primary nationally chartered…— SoFi (@SoFi) December 18, 2025

The corporate introduced the launch of SoFiUSD, a totally reserved stablecoin issued by SoFi Financial institution, N.A., positioning the financial institution not solely as a consumer-facing issuer but in addition as an infrastructure supplier for different banks, fintech companies, and enterprise platforms.

SoFi Brings Stablecoins Contained in the Banking System

Based on SoFi, the stablecoin is stay for inner settlement exercise and will probably be made out there to SoFi members within the coming months.

The launch locations SoFi on the heart of a fast-moving shift in U.S. monetary regulation, the place federal businesses are starting to formally combine blockchain-based cost devices into the banking system slightly than treating them as an exterior danger.

SoFiUSD is issued straight by SoFi Financial institution, an OCC-regulated and FDIC-insured depository establishment, and is backed one-to-one by money reserves held on the Federal Reserve.

That construction seeks instant redemption whereas avoiding credit score or liquidity danger tied to industrial paper or different yield-bearing devices.

As a nationwide financial institution, SoFi is required to offer licensed reserve reporting underneath the principles established by the Guiding and Establishing Nationwide Innovation for U.S. Stablecoins Act, or GENIUS Act, which was signed into regulation in July 2025.

GENIUS Act Ends Years of Stablecoin Uncertainty for U.S. Banks

The GENIUS Act created the primary complete federal framework for cost stablecoins in the US.

It permits insured depository establishments to difficulty stablecoins by way of authorized buildings, offered they meet strict reserve, disclosure, and supervisory necessities.

Up to date steerage from the OCC and FDIC adopted within the months after the regulation’s passage, explicitly permitting banks to have interaction in stablecoin issuance, custody, and tokenized settlement underneath an outlined rulebook.

OCC authorizes US banks to facilitate shopper crypto trades by way of riskless principal transactions, eradicating structural obstacles to digital asset companies.#OCC #USbanks #Cryptohttps://t.co/e2BCyJG9hc

— Cryptonews.com (@cryptonews) December 10, 2025

That readability reversed years of uncertainty that had beforehand compelled SoFi to pause its crypto companies in 2023.

SoFi mentioned the stablecoin will probably be used throughout a variety of settlement features, together with crypto buying and selling, card community settlement, service provider funds, and worldwide remittances.

For customers in nations with risky currencies, the corporate plans to help SoFiUSD as a dollar-denominated stability inside debit or secured credit score merchandise.

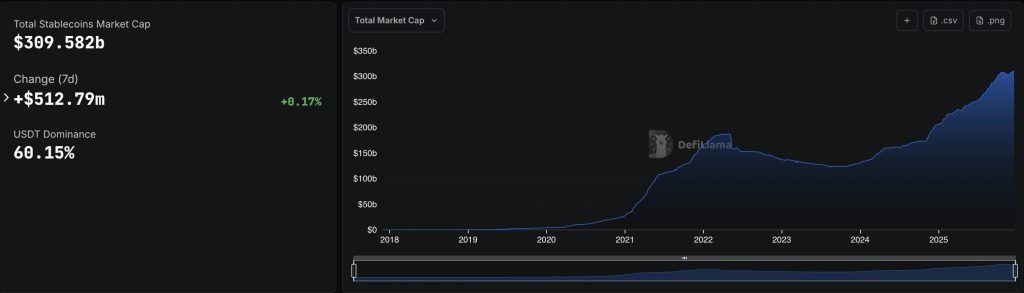

The launch comes because the stablecoin market continues to develop quickly. Knowledge from DefiLlama exhibits the whole stablecoin market capitalization at roughly $309 billion, with Tether’s USDT accounting for greater than $186 billion and Circle’s USDC near $78 billion.

Analysts venture that the worldwide stablecoin market might exceed $3 trillion by 2030, pushed by demand for sooner settlement, lower-cost cross-border funds, and entry to greenback liquidity outdoors the standard banking system.

Stablecoins Step Into the Mainstream as U.S. Oversight Tightens

Regulatory momentum has accelerated alongside market progress. On December 16, the FDIC authorized a proposed rule outlining how FDIC-supervised banks can apply to difficulty cost stablecoins underneath the GENIUS Act.

U.S. banks are cleared to difficulty dollar-backed stablecoins underneath a federal framework as @FDICgov unveils draft guidelines underneath the GENIUS Act.#Stablecoins #FDIC #GENIUShttps://t.co/TelgvOhEAg

— Cryptonews.com (@cryptonews) December 17, 2025

The proposal establishes a proper software course of and confirms that solely authorized entities, generally known as permitted cost stablecoin issuers, can difficulty such property within the U.S.

The OCC has conditionally authorized 5 crypto companies, together with @Circle and @Ripple, to launch nationwide belief banks.#Ripple #Circlehttps://t.co/wCeTNrhOQZ

— Cryptonews.com (@cryptonews) December 13, 2025

Earlier this month, the OCC additionally conditionally authorized a number of crypto companies, together with Circle and Ripple, to pursue nationwide belief financial institution charters, bringing extra digital-asset corporations underneath a single federal supervisory framework.

The put up SoFi Makes Historical past: First U.S. Nationwide Financial institution to Concern Stablecoin on Public Blockchain appeared first on Cryptonews.

Leave a Reply