In a bullish bit of reports for on a regular basis crypto utilization, Steak ‘n Shake stories that Bitcoin funds have “dramatically” lifted same-store gross sales during the last 9 months.

9 months in the past at this time, Steak n Shake launched its burger-to-Bitcoin transformation once we began accepting bitcoin funds. Our same-store gross sales have risen dramatically ever since.

Bitcoin funds for Steak n Shake burgers go into our Strategic Bitcoin Reserve, which then…— Steak 'n Shake (@SteaknShake) February 16, 2026

The 90-year-old burger chain is now routing all crypto income instantly right into a Strategic Bitcoin Reserve, successfully mixing retail operations with institutional asset accumulation.

That is not only a advertising stunt, it’s a steadiness sheet technique.

Key Takeaways:

- Gross sales Development: Reported 15% same-store gross sales leap by October 2025 and 18% progress in 2026, considerably outpacing trade averages.

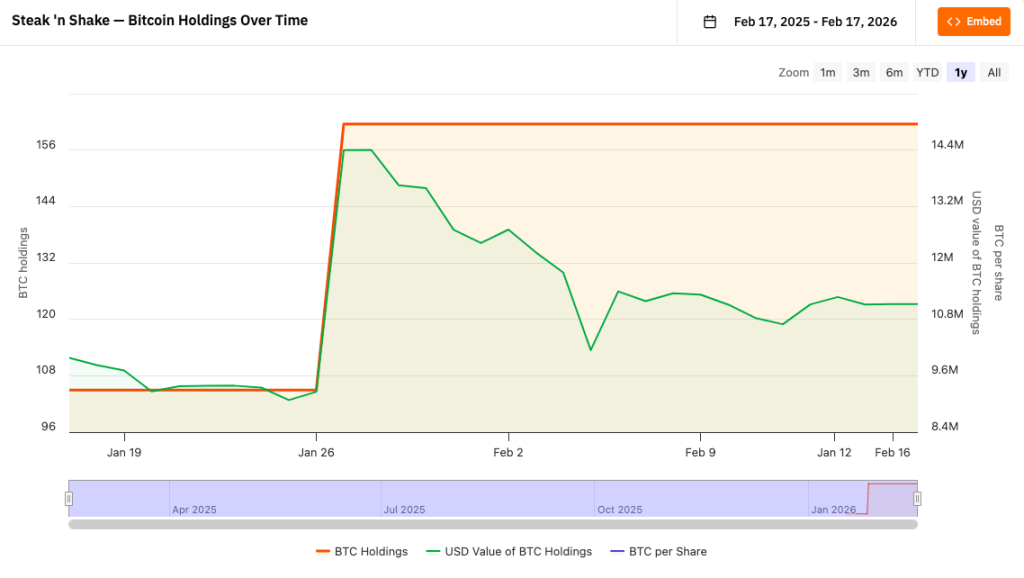

- Treasury Technique: The corporate now holds roughly 168.6 BTC (valued close to $15 million) in its Strategic Bitcoin Reserve.

- Operational Effectivity: Lightning Community transactions have lowered fee processing charges by almost 50% in comparison with conventional bank cards.

Is Knowledge Lastly Overtaking the Hype?

Steak ‘n Shake started this pivot 9 months in the past, and the info suggests it’s paying off.

Whereas Wall Road corporations like BlackRock and Goldman Sachs are quietly doubling down on crypto, this chain selected to go loud.

Not like rivals testing the waters with third-party processors that immediately convert to fiat, Steak ‘n Shake is holding the asset.

The corporate said the transfer has pushed a “sharp rise” in gross sales. It alerts a shift from utilizing crypto as a novelty to treating it as each digital gold and digital money.

Company adoption is shifting from tech-native corporations to conventional companies in search of laborious asset reserves.

Uncover: The perfect meme cash available on the market.

Contained in the Treasury and Bonus Mannequin

The financials present a dense dedication to the ecosystem. Steak ‘n Shake has gathered roughly 168.6 Bitcoin, valued at round $15 million.

This reserve was constructed via a mixture of buyer receipts and direct treasury allocations, together with a $10 million preliminary funding in Could 2025 and subsequent buys in January 2026.

This mirrors how different corporations plan to equitize convertible debt into Bitcoin to strengthen long-term solvency.

Past holding the asset, the operational mechanics are yielding quick margins. By processing funds by way of the Lightning Community, the chain stories transaction payment financial savings of almost 50% versus normal bank card rails.

The technique extends to the workforce as nicely. Beginning March 1, the corporate will problem bonuses to hourly workers at company-operated areas.

Beginning March 1, Steak n Shake will give all hourly workers at its company-operated eating places a Bitcoin bonus of $0.21 for each hour labored.

Staff will have the ability to acquire their Bitcoin pay after a two-year vesting interval. Thanks, @Fold_app, for the help.

We…— Steak 'n Shake (@SteaknShake) January 20, 2026

Staff will accrue $0.21 value of Bitcoin for each hour labored, making a vesting retention mechanism tied to the asset’s efficiency.

A New Normal for Retail?

Steak ‘n Shake’s metrics problem the narrative that Bitcoin is just too gradual or risky for commerce.

The burger chain’s quick deliberate enlargement into El Salvador, the place Bitcoin is authorized tender, alerts world ambitions.

This integration displays a broader institutional development. As Trump-linked Reality Social information for Bitcoin staking ETFs and Elon Musk’s X launches good cashtags for buying and selling, the infrastructure between client apps and crypto rails is hardening.

Steak ‘n Shake simply supplied the proof of idea that it really works for burgers, too.

Uncover: The perfect new crypto to be careful for.

The put up Steak ‘n Shake Stories Bitcoin Acceptance Has ‘Dramatically’ Lifted Gross sales in 9 Months appeared first on Cryptonews.

Leave a Reply