A brand new report from cryptocurrency change CEX.IO exhibits that tokenized gold turned one of many fastest-growing segments of the real-world asset (RWA) market in 2025.

Buying and selling exercise and market enlargement outpaced many conventional gold funding merchandise.

Tokenized Gold Accounts for a Quarter of RWA Progress

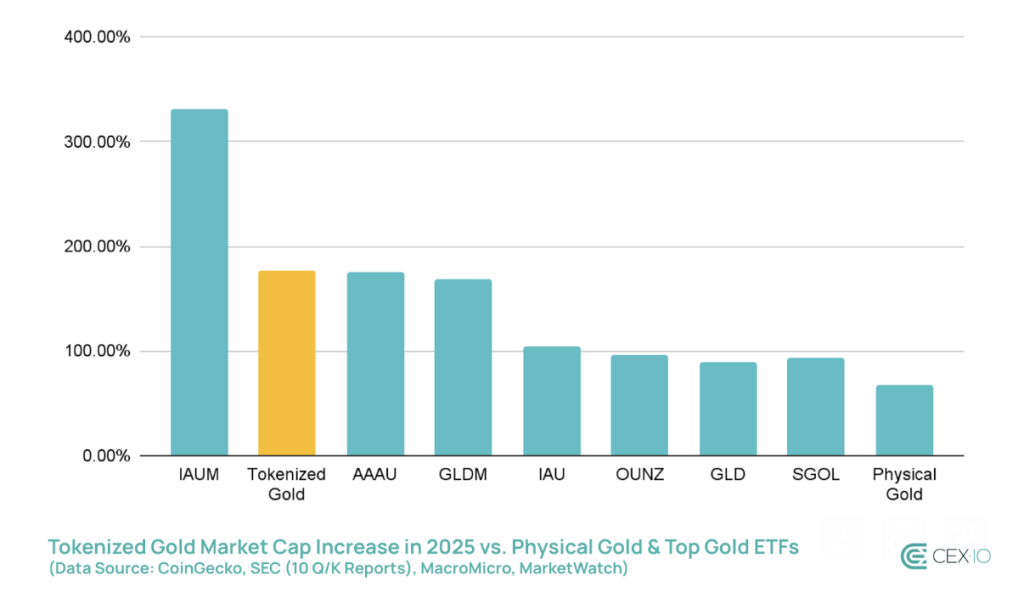

Based on the report, tokenized gold recorded a 177% enhance in market capitalization in 2025, increasing from roughly $1.6 billion to $4.4 billion. This added almost $2.8 billion in internet worth accounting for round 25% of all internet RWA development over the 12 months.

In distinction the broader DeFi market struggled to regain momentum with whole worth locked (TVL) rising by simply 2% whereas RWAs grew by roughly 184% making them crypto’s standout performer.

CEX.IO notes that tokenized gold expanded 2.6 instances sooner than bodily gold which itself noticed a robust 12 months amid inflation considerations and geopolitical uncertainty.

The class additionally registered a 198% enhance in whole holders, including greater than 115,000 new wallets—development that outpaced tokenized U.S. Treasuries and different tokenized bonds.

Buying and selling Volumes Rival Gold ETFs

Buying and selling exercise tells an much more hanging story. Tokenized gold buying and selling quantity jumped 1,550% year-on-year, reaching $178 billion in whole quantity in 2025. Within the fourth quarter alone quantity exceeded $126 billion surpassing the mixed buying and selling quantity of 5 main gold ETFs.

Whereas SPDR Gold Shares (GLD) remained the one largest gold funding product by quantity the report estimates that tokenized gold would rank because the second-largest gold funding automobile globally by buying and selling quantity forward of each ETF besides GLD. This highlights a structural shift in the place gold buying and selling liquidity is forming more and more transferring on-chain.

A Extremely Concentrated Market

Regardless of speedy development, the market stays extremely concentrated. The highest three tokenized gold belongings—Tether Gold (XAUT), Pax Gold (PAXG) and Kinesis Gold (KAU)—management roughly 97% of whole market capitalization whereas the highest 4 account for 99% of buying and selling quantity.

XAUT dominated buying and selling exercise in late 2025 representing 75% of whole This autumn quantity following a reserve attestation that appeared to spice up market confidence.

CEX.IO additionally highlighted rising merchandise corresponding to Matrixdock Gold (XAUM) which noticed market cap development of greater than 1,000% after integration with the Plume ecosystem.

Complementing Not Changing Stablecoins

The report explains that tokenized gold just isn’t competing immediately with stablecoins however as a substitute acts as a tactical hedge. In periods of market stress, merchants seem to rotate capital into tokenized gold as a center floor between risk-on crypto belongings and risk-off stablecoins.

General, CEX.IO concludes that 2025 marked a turning level for tokenized gold, remodeling it from a distinct segment RWA class right into a large-scale, liquid gold funding automobile.

Whereas focus dangers stay the information suggests tokenized gold is now firmly established as a significant part of each the RWA and world gold funding panorama.

The submit Tokenized Gold Accounts for 25% of RWA Progress as Buying and selling Quantity Overtakes Gold ETFs appeared first on Cryptonews.

Leave a Reply