Crypto merchants are abandoning token hypothesis in favour of prediction markets following a brutal $150 billion altcoin crash, with platforms like Polymarket seeing app installs surge from 30,000 to over 400,000 between January and December 2025, based on Bloomberg.

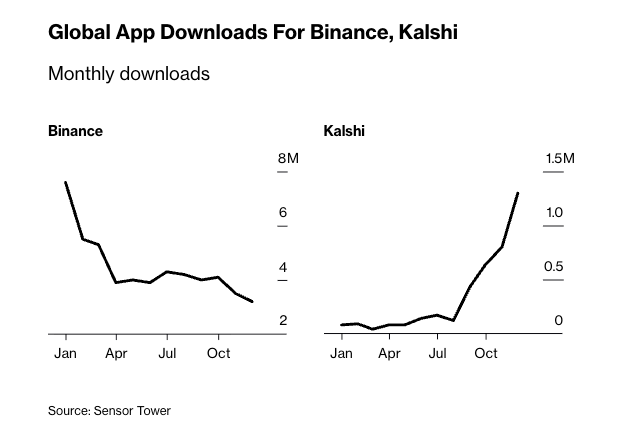

Weekly buying and selling quantity throughout prediction platforms, together with Polymarket and Kalshi, exploded from $500 million in June to almost $6 billion in January, knowledge from Dune reveals, whereas crypto alternate downloads collapsed by greater than half throughout the identical interval.

The shift displays deep fatigue throughout the token financial system after Bitcoin plunged practically 30% from its October peak and greater than 11 million cash successfully died final 12 months, marking the most important extinction occasion in crypto historical past, based on CoinGecko.

In accordance with CoinShares, digital asset funding merchandise shed $1.73 billion within the largest weekly outflow since mid-November 2025, pushed by fading rate-cut expectations and chronic bearish sentiment.

Final week, Bitcoin spot ETFs additionally bled $1.62 billion over 4 consecutive buying and selling days as hedge funds unwound foundation trades that now yield under 5%.

Crypto Natives Migrate to Occasion Betting

Former memecoin merchants are main the exodus towards prediction markets that supply binary odds on real-world occasions moderately than multi-year token roadmaps.

Nikshep Saravanan, who deserted his digital creator startup to construct HumanPlane, a prediction market analysis platform, mentioned the shift made sense after shedding traction with out funding.

“Right here I can do much more with no capital,” the 27-year-old Canadian defined. “There’s a lot extra curiosity right here.“

Tre Upshaw adopted an identical path after shedding cash on memecoins like SafeMoon, now operating Polysights, an analytics dashboard for prediction markets.

“I spotted that’s simply hyper playing,” he mentioned. “I received burned so many instances on memecoins.”

But losses stay widespread throughout prediction markets too, with 70% of buying and selling addresses displaying realized losses, whereas fewer than 0.04% of Polymarket addresses captured over 70% of whole realized earnings totalling $3.7 billion.

70% of Polymarket merchants misplaced cash whereas the highest 0.04% captured over $3.7 billion in earnings, revealing excessive focus in prediction markets.#Polymarket #Tradershttps://t.co/E5CeFnJIwR

— Cryptonews.com (@cryptonews) December 29, 2025

The infrastructure supporting these markets stays basically crypto-powered regardless of merchants fleeing token hypothesis.

On Polymarket, each key a part of trades besides order-matching occurs on-chain, revealing blockchain know-how’s most sturdy use case but as belief-driven hypothesis cools.

Crypto contracts have turn out to be the second-busiest buying and selling class on Polymarket, up from fourth place a 12 months in the past, with notional crypto quantity rising practically tenfold throughout main platforms, based on Dune knowledge.

Exchanges Rush Into Prediction Markets

Main crypto platforms are aggressively increasing into occasion contracts as person demand shifts.

Coinbase added prediction markets in December by Kalshi routing, with Clear Avenue analyst Owen Lau projecting the alternate might generate $700 million in prediction market income for 2025, whereas Robinhood’s annual run fee already approaches $300 million.

Gemini and Crypto.com have additionally launched their very own prediction market efforts, with Crypto.com white-labeling companies for Trump Media.

“As we add extra devices, they have an inclination to enrich one another,” mentioned Max Branzburg, Coinbase’s head of shopper and enterprise merchandise, noting the agency has “seen tons of pleasure” from customers wanting a single venue to commerce every little thing.

A Mizuho survey cited by Bloomberg discovered that Coinbase and Robinhood customers had been 9 instances extra probably to make use of prediction platforms than the overall inhabitants.

Polymarket returned to the U.S. market following CFTC approval, launching with ultra-low 10 foundation level taker charges and nil maker charges, the bottom amongst main platforms based on Clear Avenue analyst Owen Lau.

Polymarket is again within the U.S. after CFTC approval. Clear Avenue analyst says prediction markets might turn out to be an engagement device for platforms like Coinbase. #Polymarket #Coinbasehttps://t.co/h9EX7a4YFn

— Cryptonews.com (@cryptonews) January 26, 2026

The platform additionally not too long ago rolled out actual property bets that enable crypto merchants to now speculate on housing costs

The corporate raised $205 million throughout two funding rounds and secured a $2 billion funding from Intercontinental Alternate at a valuation of practically $9 billion.

Final month, Kalshi additionally closed a $1 billion spherical at an $11 billion valuation and secured CNN as its official prediction markets companion.

Regardless of near-term outflows, 70% of establishments view Bitcoin as undervalued in a current Coinbase Institutional and Glassnode survey, and 62% keep or enhance crypto positions since October’s crash.

“Crypto markets are coming into 2026 in a more healthy state, with extra leverage having been flushed from the system,” mentioned David Duong, Coinbase International Head of Analysis.

The publish Polymarket Installs Soar 1,200% as Crypto Loses $150B – Are Crypto Merchants Executed With Tokens? appeared first on Cryptonews.