Bitcoin is approaching a traditionally vital help zone close to $62,000, as a long-tracked reserve-cost indicator tied to Binance alerts that BTC may see extra ache forward.

The $62k reserve price stage has not been examined because the approval of U.S. spot Bitcoin ETFs in January 2024, elevating recent questions over whether or not the present drawdown marks a deeper bear section relatively than a routine correction.

The warning comes as a number of technical and on-chain indicators flip bearish concurrently, at the same time as components of the market stay positioned for a renewed bull cycle in 2026.

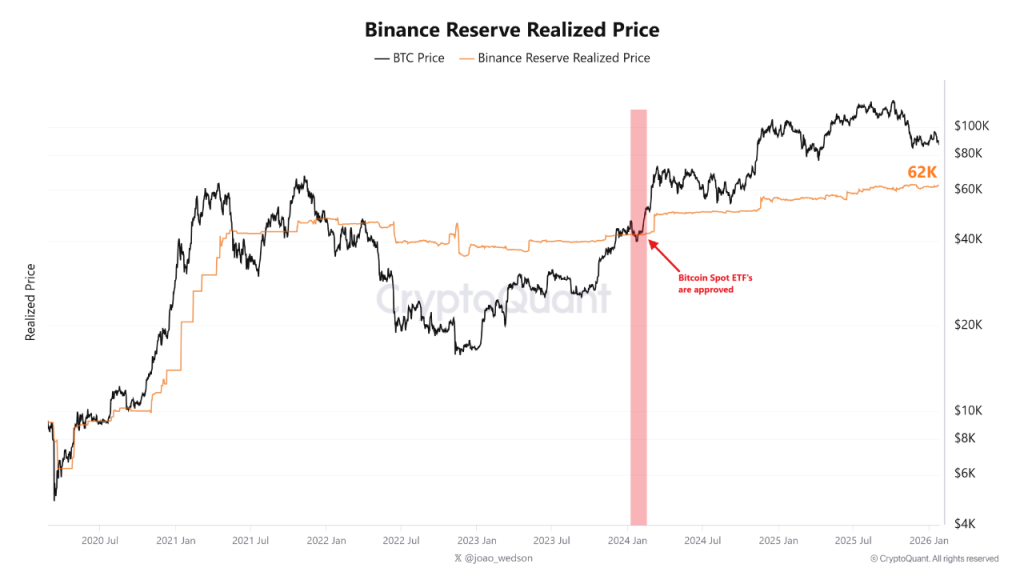

Binance Reserve Price Shifts the Submit-ETF Flooring

The Binance Reserve RP, which tracks the typical acquisition price of Bitcoin reserves on the trade, has traditionally acted as a dividing line between bull and bear markets.

In line with information shared by crypto analyst Burak Kesmeci, that stage now sits at $62,000, a pointy rise from pre-ETF norms.

Earlier than spot ETFs have been authorized, the indicator hovered round $42,000, reflecting a special market construction dominated by retail and offshore flows.

Since January 2024, institutional participation has altered worth habits, lifting the reserve price and redefining what constitutes draw back help.

“Bitcoin has by no means examined this stage since Spot ETF approval,” Kesmeci mentioned, noting that the value spent your entire bull run effectively above the $62,000 zone.

In his view, worth motion this yr will decide whether or not $62,000 holds as a structural flooring or breaks.

On-Chain Metrics Level to Early Bear Construction

Past exchange-based indicators, on-chain information can also be flashing warning.

Bitcoin’s Provide in Loss has begun trending greater once more, a shift that has traditionally marked the early levels of bear markets.

In previous cycles in 2014, 2018, and 2022, the metric turned upward earlier than costs reached their eventual lows.

Throughout these intervals, losses steadily unfold from short-term holders to longer-term members as costs continued to weaken.

At current, Provide in Loss stays effectively beneath ranges seen throughout full capitulation phases.

CryptoQuant’s head of analysis, Julio Moreno, has pointed to the same clustering of bearish alerts that emerged in early November and have but to reverse.

He argues that the market should be within the strategy of finding a sturdy backside.

How Low Might Bitcoin Go?

Utilizing Bitcoin’s realized worth, which displays the typical price foundation of present holders, Moreno estimates a possible bear market low beneath the $62,000 reserve price.

His projected vary sits between $56,000 and $60,000 over the following yr.

Traditionally, extended downturns have seen Bitcoin drift again towards realized worth after overshooting throughout bull markets.

A transfer into that zone would indicate a drawdown of roughly 55% from Bitcoin’s all-time excessive above $125,000.

Whereas substantial, Moreno views such a decline as comparatively modest in contrast with prior bear markets.

Earlier cycles typically produced losses of 70% to 80%, ceaselessly amplified by cascading failures throughout the crypto sector.

Bitcoin Technicals Conflict With Bullish Narratives

Technical indicators are additionally including stress to the bearish case.

A crossover of the 21-week and 50-week exponential transferring averages, sometimes called the Bull Market EMA crossover, has lately appeared.

Traditionally, related crossovers preceded deeper bear phases in This autumn 2014, late Q3 2018, and early Q2 2022.

If the present Bitcoin section is certainly a bear market, it might problem expectations that 2026 will ship one other sturdy development section for Bitcoin.

Binance founder Changpeng Zhao has promoted the concept of a Bitcoin “supercycle,” whereas Grayscale researchers have questioned the relevance of the normal four-year cycle.

@Grayscale predicts Bitcoin may set a brand new all-time excessive in early 2026 as institutional demand builds and traders lean more durable into various shops of worth.#Grasycale #BitcoinPricePrediction https://t.co/AAdSK63MvJ

— Cryptonews.com (@cryptonews) December 16, 2025

Bernstein has additionally maintained a $150,000 goal for 2026, describing the present setting as an “elongated bull market.”

Whether or not these forecasts maintain might rely on Bitcoin reclaiming its 50-week transferring common, presently close to $100,988.

Till then, analysts say the market stays centered on draw back danger administration.

With greater than $4.5 billion in realized losses recorded since BTC fell beneath $90,000, the following help check may outline the cycle’s true low.

The publish Bitcoin’s Historic Backside Indicator Factors to $62K – Might BTC Fall That Low? appeared first on Cryptonews.