Key Takeaways:

- Prediction markets like Polymarket have gotten a significant crypto narrative in 2026, pushed by excessive win charges and visual income.

- Accounts with near-perfect efficiency are sometimes powered by automation, not market prediction.

- Bots exploit short-term pricing inefficiencies, particularly throughout excessive volatility, slightly than guessing outcomes.

- Instruments like Clawdbot decrease the barrier to automation however introduce new dangers, together with technical failures and lack of management over funds.

- Automation can create an edge, nevertheless it doesn’t change market understanding, danger administration, or long-term sustainability.

Prediction markets, led by Polymarket, have gotten one of many key crypto narratives in 2026. Individuals are watching different customers put up spectacular win charges and make severe cash on daily basis. Naturally, they need the identical. However is it actually that easy?

At its core, prediction markets are simple. You place a guess on an final result and wait to see the way it performs out. Some markets concentrate on massive macro questions, like whether or not rates of interest can be minimize or raised. Others are a lot narrower. Throughout the Monad (MON) token launch, for instance, there was a market the place customers may guess on how a lot cash the ICO would increase.

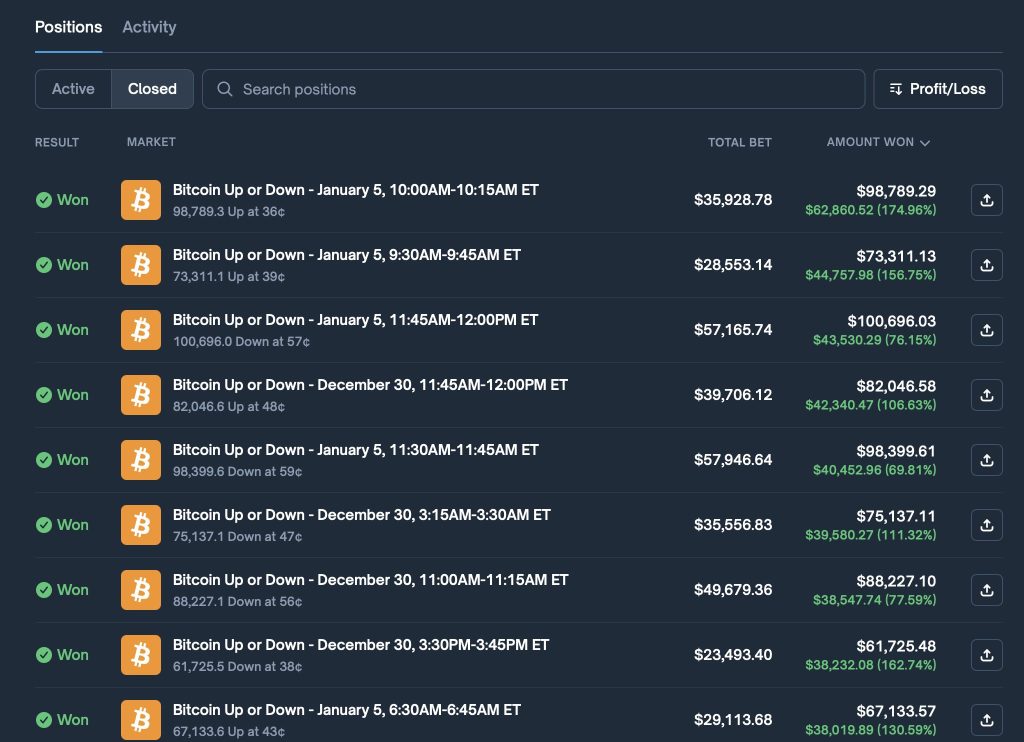

One Polymarket consumer, often known as Account88888, took a really completely different strategy. As an alternative of long-term narratives, they centered on 15-minute Bitcoin worth markets, merely betting on whether or not BTC would go up or down. In a single instance, the consumer positioned $35,928.78 and walked away with $62,860.52, a return of 174.96%.

Account88888’s win fee sits near 100%. That instantly raised questions amongst skilled Polymarket customers. Is that this actually a human dealer? Or is one thing else happening? The probably rationalization is automation.

On X, bots promising “hands-off” buying and selling are in every single place.

‘As an alternative I realized they don’t suppose in any respect. They calculate’

A Polymarket dealer often known as Marlow says he has been monitoring related accounts for some time, together with Account88888. At first, the technique regarded unusual. On the floor, it appeared just like the form of strategy that ought to lose cash, not generate constant income.

“Account88888. 99% win-rate. Over 11,000 trades. The script surfaced in minutes,” Marlow wrote.

The important thing level is that the bot shouldn’t be attempting to foretell the market. It’s mechanically extracting arbitrage from pricing inefficiencies on Polymarket.

Each Polymarket market works the identical approach. There are solely two outcomes. When the market settles, the successful facet pays $1, the shedding facet pays nothing. Costs earlier than settlement merely replicate how doubtless every final result appears at that second. They don’t change the ultimate payout.

This creates a chance in periods of excessive volatility. If each opposing outcomes are quickly underpriced and their mixed value drops beneath $1, an arbitrage seems. You might be successfully shopping for a assured $1 payout for lower than its face worth.

In risky moments, merchants rush to hedge towards completely different situations on the identical time. Demand turns into distorted. Costs on either side get pushed down. In some circumstances, the “UP” and “DOWN” contracts on the identical market may commerce at, for instance, $0.30 and $0.35 mixed, nonetheless beneath $1, though one in all them should pay out $1 at settlement.

The bot merely buys either side, waits for the market to resolve, and collects the distinction. Time and again. Hundreds of instances. It income from mathematical certainty created by momentary imbalances in provide and demand.

Marlow explains it plainly:

The bot buys each. Waits fifteen minutes. Collects $1. Retains six cents. Repeats. It doesn’t care about route. Doesn’t learn charts. Doesn’t react to information. It farms the unfold between panic pricing and mathematical certainty. My scanner retains discovering extra of those. Completely different methods, however the identical signature. Execution patterns too clear and too quick for human palms. I constructed this instrument anticipating to find out how the most effective merchants suppose. As an alternative I realized they don’t suppose in any respect. They calculate.

‘Automation Is a Heavy Benefit in 2026’: Clawdbot (Now Moltbot) Enters Polymarket

As tales like this unfold, adverts began showing on X selling bots that promise to commerce on Polymarket or different prediction markets in your behalf. On the identical time, curiosity in AI brokers has continued to develop, though the area was already crowded.

Developed by Peter Steinberger, Clawdbot, now rebranded as Moltbot, guarantees to make working with AI brokers much more seamless.

In easy phrases, Clawdbot is a regionally working AI agent that connects a big language mannequin with actual actions on a consumer’s laptop. It may run terminal instructions, learn and write recordsdata, set up software program, browse the online, and ship messages via messengers.

Customers work together with Clawdbot via acquainted chat apps like Telegram, WhatsApp, or iMessage. Behind the scenes, the agent decides which instruments to make use of and which actions to take, primarily based on context, directions, reminiscence, and accessible capabilities. In follow, it features like a continually working private service that receives textual content instructions and executes them immediately on the system the place it’s put in.

Clawdbot has now made its technique to Polymarket as effectively.

A dealer often known as Xmaeth on X, who has round 33,000 followers, shared how they arrange Clawdbot to commerce on Polymarket. This put up has already reached 1.6 million views. The dealer gave the agent $100 and API entry to the Polymarket account, instructing it to commerce 15-minute BTC markets with conservative danger administration. In line with Xmaeth, the steadiness grew to $347 in a single day.

Xmaeth conclusion was easy:

Automation is a heavy benefit in 2026. Put it aside to re-read later.

Automation Isn’t Magic on Polymarket

The rise of Clawdbot and related instruments doesn’t imply prediction markets have was a one-click cash machine. These brokers require technical setup, belief within the code, and full entry to funds. Outcomes are sometimes proven over quick time frames, with little proof of long-term stability.

The dangers are actual, particularly when bigger quantities of capital are concerned. One unsuitable commerce, one bug, and losses can escalate shortly.

Automation additionally will increase competitors. As extra bots enter the market, apparent inefficiencies get exploited sooner, leaving much less revenue for late individuals.

Polymarket’s instance reveals that revenue in crypto can nonetheless come from many paths. Algorithmic arbitrage is one. Handbook methods and market construction evaluation are others. However as all the time, it’s not the bot itself that creates an edge. It’s an understanding of how the market works. With out that, neither automation nor AI gives a sustainable benefit.

One other open query is how Polymarket, and prediction markets extra broadly, will reply. On one hand, bots appeal to consideration and customers chase “simple cash.” However, regulators are unlikely to look kindly on totally automated extraction methods, particularly given Polymarket’s present regulatory challenges.

Whether or not these bots stay efficient over time remains to be unclear. What is obvious is that as their numbers develop, so will circumstances of abuse, scams, and unsightly outcomes.

That results in the most important query of all. If this actually works at scale, do Polymarket, Clawdbot, and related instruments change how we take into consideration work, earnings, and markets? Will we transfer towards a world the place cash may be generated robotically, at scale? Or does that imaginative and prescient collapse beneath regulation, competitors, and actuality?

For now, the questions are piling up sooner than the solutions.

Disclaimer: Crypto is a high-risk asset class. This text is supplied for informational functions and doesn’t represent funding recommendation.

The put up Is Clawdbot Making a ‘99% Win-Charge’ on Polymarket? appeared first on Cryptonews.