A extreme sell-off over the weekend that wiped about $250 billion off the cryptocurrency market has rekindled hypothesis that the digital belongings are in a structural failure or merely responding to macro stressors.

Although all costs within the trade have tumbled ferociously, market analysts declare that it’s a contraction of the U.S. liquidity state of affairs and never a collapse of crypto markets.

Raoul Pal, founder and CEO of International Macro Investor, stated {that a} momentary lack of U.S. greenback liquidity is triggered by a sequence of macro occasions, corresponding to repeated authorities shutdowns, Treasury money administration dynamics, and a vacuum of danger capital.

Bitcoin’s Drop Mirrors Tech Shares as Liquidity Tightens, Pal Says

In a submit printed on X over the weekend, Pal pushed again towards claims that Bitcoin and crypto had “damaged” or indifferent from conventional markets, arguing as a substitute that related strain has appeared throughout different long-duration belongings.

https://t.co/M5mLAi3XLA

— Raoul Pal (@RaoulGMI) February 1, 2026

Pal cited analogies between Bitcoin and the U.S. software-as-a-service equities, saying that the 2 asset lessons have been virtually similar of their worth actions all through the downturn.

He stated this means a shared macro driver quite than sector-specific weak spot.

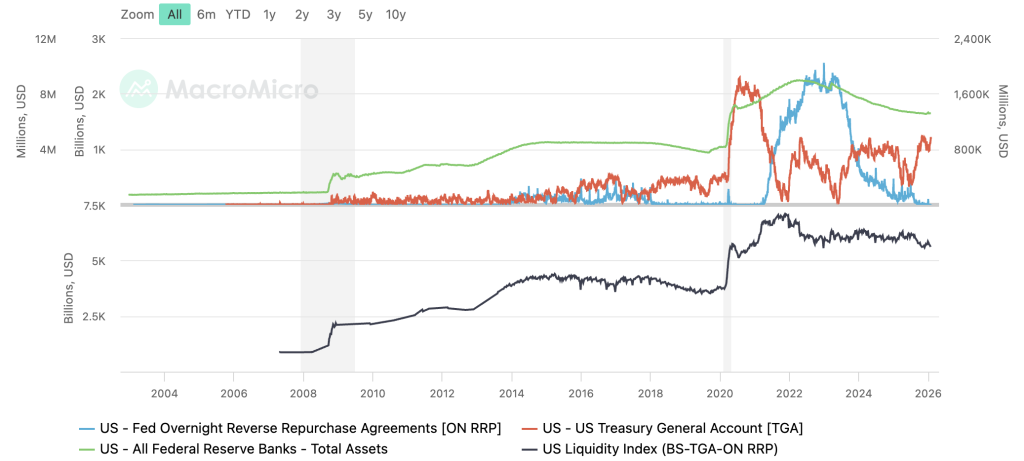

In his evaluation, he identified that U.S. complete liquidity has change into the dominant issue on this part of the cycle, outweighing broader world liquidity measures that sometimes correlate extra intently with crypto costs.

The liquidity squeeze, Pal argued, stems from a mixture of things that decreased the quantity of capital circulating by way of the monetary system.

These are the end of the Federal Reserve reverse repo facility drawdown in 2024, a reconstruction of the Treasury Normal Account in mid-year 2025, and the consequences of the current partial U.S. authorities shutdown.

U.S. President Donald Trump signed a invoice on Wednesday that formally ended the nation's longest authorities shutdown.#DonaldTrump #GovernmentShutdownhttps://t.co/pTDbHsvj8O

— Cryptonews.com (@cryptonews) November 13, 2025

He additionally included {that a} strong rise in gold additionally averted marginal liquidity that might have in any other case been pumped into much less dangerous belongings like crypto and high-growth equities.

Market information can also be indicative of the magnitude of the harm, as Bitcoin plunged over 10% from a weekend excessive close to $84,000 to lows of roughly $76,000 to ascertain one of many largest CME futures gaps in historical past.

Bitcoin and Ethereum Sink as Derivatives Curiosity Hits 9-Month Low

On the time of writing, Bitcoin was buying and selling at $76,839, which is a 12.6% decline over the last week and 39% beneath its all-time worth. Ethereum was topic to even larger losses, falling by virtually 7% in 24 hours to about 2243 and nonetheless greater than 54% beneath its excessive.

The crypto market generally has been experiencing the identical development, with a complete market capitalization happening to roughly $2.66 trillion, which was beforehand round $3 trillion only a week earlier.

Liquidations had been quick, and over $2.5 billion was worn out in a single day, with over $5.4 billion liquidated since Thursday, in accordance with CoinGlass information.

The general curiosity in all derivatives markets has dropped to about $24.2 billion, its lowest level in 9 months, with leveraged positions flushed out.

The selloff was coupled with dystrophic liquidity on weekends and a succession of macro information, corresponding to commerce tensions, growing yields in long-dated Japanese authorities bonds, and growing geopolitical dangers within the Center East and Asia.

On-chain indicators counsel confidence stays fragile. Change outflows dropped sharply after the sell-off, displaying restricted dip shopping for, whereas giant Bitcoin holders decreased publicity by an estimated 10,000 BTC since early February.

Brief-term holders are deep in unrealized losses, with NUPL metrics sitting in capitulation territory, although not but at ranges traditionally related to last market bottoms.

Analysts notice that with out stronger accumulation from long-term traders, such rallies are likely to fade.

The submit US Liquidity Disaster Sparked $250B Crash, Not a ‘Damaged’ Crypto Market: Analyst appeared first on Cryptonews.