Bhutan unveiled a nationwide Bitcoin Growth Pledge on Tuesday, committing as much as 10,000 BTC, value roughly $1 billion, to fund building of Gelephu Mindfulness Metropolis with out liquidating its sovereign digital asset reserves.

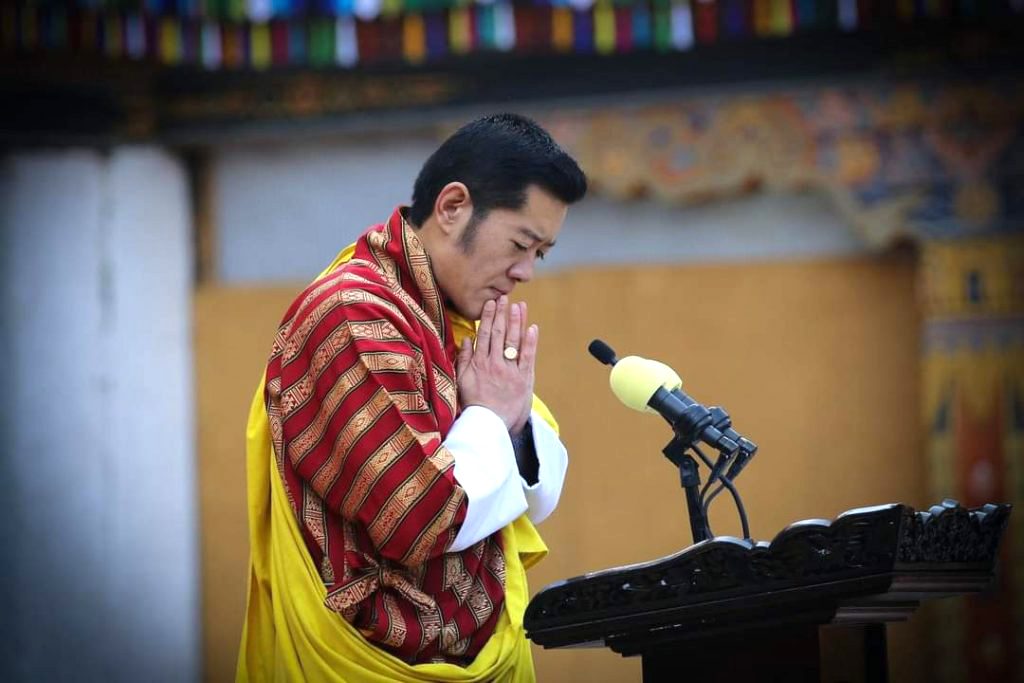

King Jigme Khesar Namgyel Wangchuck introduced the allocation throughout his Nationwide Day Handle, framing the dedication as a generational funding in youth employment and nationwide prosperity tied to a brand new financial hub in southern Bhutan.

The pledge channels Bitcoin holdings into GMC growth by means of mechanisms together with collateralized lending, risk-managed yield methods, and long-term holding approaches designed to protect capital whereas financing infrastructure.

This growth turned attainable resulting from a multi-year dedication to leverage Bitcoin’s compounding worth over time, slightly than changing reserves to money.

Officers stated the ultimate implementation particulars are anticipated within the coming months, beneath governance frameworks that emphasize capital preservation, applicable oversight, and transparency.

Sovereign Mining and Clear Vitality Basis

Bhutan ranks because the world’s fifth-largest authorities Bitcoin holder, having mined 13,011 BTC since 2021 utilizing surplus hydroelectric energy from Himalayan rivers.

The renewable energy-powered mining operation converts extra nationwide grid capability into digital belongings with out further environmental affect, with crypto holdings now exceeding 11,286 BTC, valued at $1.28 billion, in response to Bitbo information.

The Kingdom’s hydroelectric sources at instances exceed home demand, enabling clear power to be transformed into long-term nationwide belongings by means of the nationwide energy era utility.

This mining technique accounts for over 25% of Bhutan’s GDP whereas sustaining environmental sustainability commitments central to the nation’s growth philosophy, which balances financial progress with ecological stewardship.

The Kingdom established Inexperienced Digital Ltd by means of GMC to develop blockchain infrastructure and, not too long ago, partnered with Cumberland DRW on digital asset buying and selling frameworks, sustainable mining growth, AI compute amenities, and nationwide stablecoin growth.

Gelay Jamtsho, Inexperienced Digital chairman, stated the collaboration connects Bhutan’s renewable power infrastructure with institutional-grade liquidity to help the nation’s diversification agenda past conventional financial sectors.

Blockchain Integration Throughout Nationwide Techniques

Past mining, Bhutan has deployed blockchain-based nationwide id programs serving 800,000 residents on Ethereum after migrating from Polygon, with the transition accomplished in October, enabling Verifiable Credentials and digital signing capabilities.

Prime Minister Tshering Tobgay stated leveraging Ethereum’s globally distributed community strengthens the safety, transparency, and resilience of digital infrastructure serving almost all the inhabitants.

Bhutan has migrated its self-sovereign id system to Ethereum, enabling 800K residents to confirm their id on a public blockchain.#Bhutan #EthereumBlockchain #BhutanNDIhttps://t.co/GxMSpUcuN3

— Cryptonews.com (@cryptonews) October 14, 2025

Again in Might, the Kingdom enabled crypto funds throughout tourism retailers by means of partnerships with DK Financial institution and Binance Pay, permitting guests to make use of over 100 cryptocurrencies for every little thing from airline tickets and lodge stays to roadside fruit stalls.

Over 100 native retailers now settle for digital belongings, with Damcho Rinzin, tourism director, describing the system as advancing innovation and inclusion whereas supporting sustainable growth targets.

Most not too long ago, Bhutan launched TER, a Solana-based token backed by bodily gold reserves distributed by means of DK Financial institution, positioning the nation among the many few experimenting with state-backed tokenized belongings.

Mindfulness Metropolis as Financial Catalyst

Gelephu Mindfulness Metropolis operates as a Particular Administrative Area designed to draw worldwide capital by means of regulatory readability and fashionable monetary connectivity whereas preserving cultural values.

King Jigme Khesar Namgyel Wangchuck framed GMC as a shared nationwide enterprise through which residents operate as stakeholders, with new land insurance policies making certain that Bhutanese from all areas profit from growth proceeds, since most acreage stays state-owned.

“As your King, I have to be certain that each Bhutanese is a custodian, stakeholder, and beneficiary of GMC,” the monarch stated. “Consider GMC as an organization and landowners as its shareholders.“

Market Outlook Helps Strategic Holding

Bitcoin traded at $87,274 at this time, up 1.9% in Asian hours as alternate reserves hit report lows and merchants awaited US inflation information.

Main asset managers, together with Bitwise and Grayscale, venture that Bitcoin will exceed its earlier all-time highs in 2026, regardless of conventional cycle concept predicting corrections, as institutional capital inflows by means of platforms like Morgan Stanley and Wells Fargo speed up adoption.

Bitwise and Grayscale predict Bitcoin will break its four-year cycle and attain new all-time highs in 2026 pushed by institutional capital and regulatory readability.#Bitcoin #Bitwise #Grayscalehttps://t.co/mL6smmtfjl

— Cryptonews.com (@cryptonews) December 16, 2025

Bhutan’s pledge aligns with the rising sovereign and company adoption of digital belongings, as international crypto ETPs have attracted $87 billion in internet inflows since US merchandise launched in January 2024.

The publish Bhutan Pledges $1 Billion in Bitcoin to Construct ‘Mindfulness Metropolis’ With out Promoting Reserves appeared first on Cryptonews.