The worldwide cryptocurrency derivatives market underwent a structural transformation in 2025, shifting away from retail-driven hypothesis towards institutional capital and extra advanced threat dynamics

In keeping with the CoinGlass 2025 Crypto Derivatives Market Annual Report the yr represents a watershed second within the maturation of crypto as a monetary asset class.

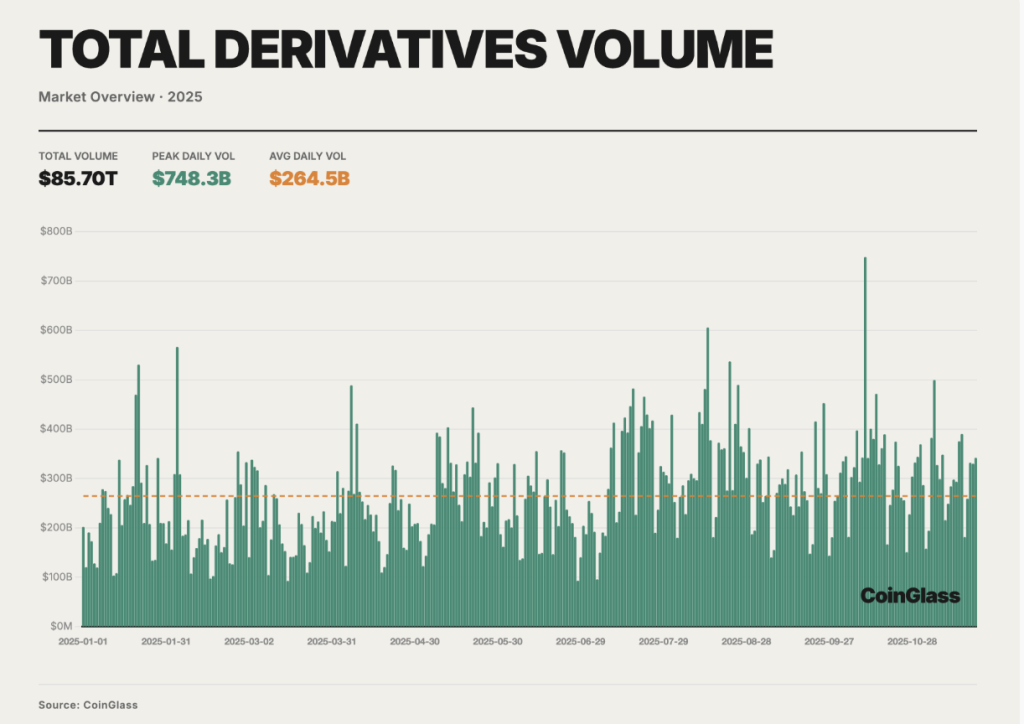

In 2025 the whole buying and selling quantity of the cryptocurrency derivatives market reached roughly $85.70 trillion with a every day common turnover of about $264.5 billion.

Institutional Capital Reshapes Market Management

One of the vital essential shifts in 2025 was the consolidation of institutional affect throughout derivatives venues. The top of yr report states that demand for hedging, foundation buying and selling and risk-managed publicity has migrated towards regulated exchange-traded merchandise, notes CoinGlass.

This has strengthened the function of the Chicago-based futures market with CME Group securing its management in Bitcoin futures after overtaking Binance in open curiosity in 2024.

By 2025 the CME additionally narrowed the hole with Binance in Ethereum derivatives exhibiting rising institutional participation past Bitcoin. On the similar time main crypto-native exchanges reminiscent of OKX, Bybit, and Bitget retaining a considerable market share.

Merry Christmas!

CoinGlass 2025 Crypto Derivatives Market Annual Reporthttps://t.co/WJ6wUNU8Hc— CoinGlass (@coinglass_com) December 25, 2025

Rising Complexity and Systemic Danger

CoinGlass notes that excessive market occasions in 2025 additionally stress-tested margin frameworks, liquidation mechanisms and cross-platform threat transmission pathways at an unprecedented scale.

Importantly these shocks now not remained confined to particular person belongings or exchanges exhibiting the rising interconnectedness of the derivatives ecosystem.

Fragility has prompted renewed scrutiny of threat controls, significantly given the focus of open curiosity and consumer belongings amongst a small variety of dominant platforms.

Macro Liquidity and Excessive-Beta Conduct

From a macro perspective CoinGlass says Bitcoin continued to behave much less like an inflation hedge and extra like a high-beta threat asset. Through the 2024–2025 easing cycle BTC surged from roughly $40,000 to $126,000, largely reflecting leveraged publicity to world liquidity enlargement moderately than impartial worth discovery.

When liquidity expectations shifted in late 2025, the pullback strengthened Bitcoin’s sensitivity to central financial institution coverage and geopolitical uncertainty.

These dynamics created fertile floor for derivatives buying and selling, as volatility linked to U.S.–China commerce tensions shifting Federal Reserve coverage, and Japan’s financial normalization generated sustained alternatives for hedging and speculative methods.

On-Chain Derivatives and the Regulatory Backdrop

One other defining theme of 2025 was the transition of decentralized derivatives from experimentation to real market competitors.

Excessive-performance utility chains and intent-centric architectures enabled on-chain platforms to rival centralized exchanges in particular niches, significantly censorship-resistant buying and selling and composable methods.

Regulation advanced in parallel. The USA moved towards legislative readability because the European Union strengthened shopper safety underneath MiCA and MiFID whereas jurisdictions reminiscent of Hong Kong, Singapore and the UAE positioned themselves as compliant hubs.

Collectively these developments level towards gradual convergence underneath the precept of “similar exercise, similar threat, similar regulation.”

A New Section for Crypto Derivatives

Taken collectively, 2025 marked the purpose at which crypto derivatives grew to become a central pillar of world digital finance moderately than a peripheral speculative market.

Institutional dominance, regulatory integration and on-chain innovation at the moment are reshaping how threat is priced, transferred and managed—setting the stage for an much more advanced derivatives panorama forward, stories CoinGlass.

The submit Crypto Derivatives Enter Institutional Period in 2025 With CME Overtaking Binance: CoinGlass appeared first on Cryptonews.