Ethereum’s worth prediction reveals that sustained draw back strain is exposing the magnitude of losses throughout a few of Ether’s most outstanding bullish positions.

As ETH has declined 19% over the previous three days to fall beneath the $2,400 stage, on-chain knowledge reveals a number of high-profile traders who collected aggressively close to cycle highs at the moment are collectively holding an estimated $7.6 billion in unrealized losses.

This raises key questions on whether or not the present pullback is a short lived reset or indicators a bearish development reversal.

Tom Lee’s Fundstrat Down $6.8B on ETH Place

Among the many most main positions is Fundstrat chairman Tom Lee, whose entity reportedly collected greater than 4.24 million ETH at a median worth close to $3,854.

Listed below are the highest 3 #Ethereum bulls — all hit with large losses. pic.twitter.com/0dUI3n2bPv

— Lookonchain (@lookonchain) February 2, 2026

At present market ranges, this interprets right into a paper lack of roughly $6.8 billion.

In the meantime, dealer Garrett Jin, related to BitcoinOG, has skilled main drawdowns following a big BTC-to-ETH rotation and subsequent leveraged publicity.

On-chain data point out Jin swapped 35,991 BTC for 886,371 ETH, realizing losses exceeding $770 million.

An extended place of 223,340 ETH was subsequently liquidated, leading to a further $195 million loss.

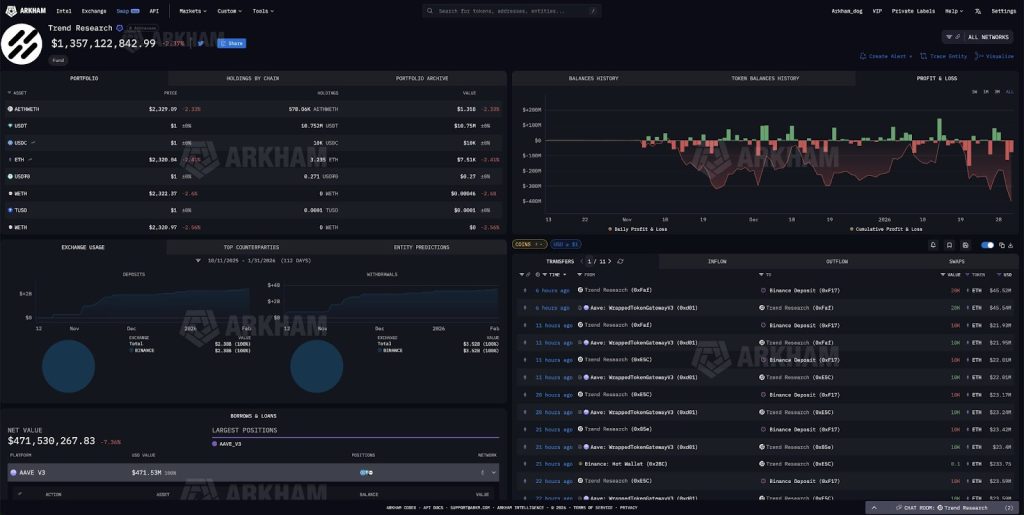

Including to the strain, Pattern Analysis’s Jack Yi is estimated to be down roughly $680 million after buying 651,000 ETH at a median value near $3,300.

Regardless of deepening drawdowns, whale conduct suggests the market stays divided between conviction shopping for and compelled danger discount.

On-chain knowledge from Lookonchain reveals that Tom Lee’s Fundstrat-affiliated entity has continued accumulating through the weak point, buying a further 41,788 ETH price roughly $96.95 million through the decline.

Technical Evaluation: Aid Rally Targets $2,700–$2,800 Resistance

The Ethereum every day chart reveals that ETH dropped decisively from the $2,800 resistance space and is at present reacting across the $2,300–$2,400 area, which represents key long-term help.

From a development and construction perspective, Ethereum stays beneath all key shifting averages, with the 20-day, 50-day, 100-day, and 200-day EMAs stacked bearishly overhead.

This confirms the broader medium-term development stays corrective, and upside strikes will doubtless encounter resistance slightly than instantly transitioning into sustained rallies.

Nonetheless, the response from $2,400 help carries technical significance. So long as this zone continues holding on a every day closing foundation, the present transfer may be interpreted as a higher-timeframe pullback slightly than a whole development reversal.

A reduction bounce towards $2,700–$2,800 is feasible, however that space now represents main resistance and have to be reclaimed with robust quantity to shift momentum.

A confirmed break above $2,800 would open the trail for motion towards the $3,200–$3,400 area, the place higher shifting averages and prior provide converge.

On the draw back, failure to take care of the $2,400 help would materially weaken the construction and expose Ethereum to a deeper decline towards the following main help close to $1,800.

ETH Down 19%—However This Memecoin Presale Simply Hit $4.5M

If ETH reclaims the $2,800 stage and resumes a bullish trajectory, presale initiatives like Maxi Doge (MAXI) might appeal to capital from traders pursuing high-ROI alternatives within the increasing memecoin sector.

Maxi Doge represents an early-stage memecoin following the Dogecoin playbook that generated over 10x returns through the 2023-2024 breakout cycle.

The presale has established an alpha channel enabling merchants to share methods and concepts, mirroring community-building ways from early Dogecoin days that cultivated engaged holder communities.

The MAXI presale has raised over $4.5 million, providing contributors 70% annual staking rewards on the present $0.0002801 worth level.

traders can take part by visiting the official Maxi Doge web site and connecting a crypto pockets like Greatest Pockets.

You should buy $MAXI tokens utilizing USDT, ETH, or a direct financial institution card for rapid entry.

Go to the Official Maxi Doge Web site Right here

The put up Ethereum Value Prediction: High ETH Bulls Sit on $7.6B Paper Loss as Value Falls Under $2,400 appeared first on Cryptonews.