Financial institution of Korea Governor Rhee Chang-yong revealed South Korea is contemplating a brand new registration regime that will permit home establishments to problem digital belongings, whereas warning that won-denominated stablecoins might allow capital move circumvention.

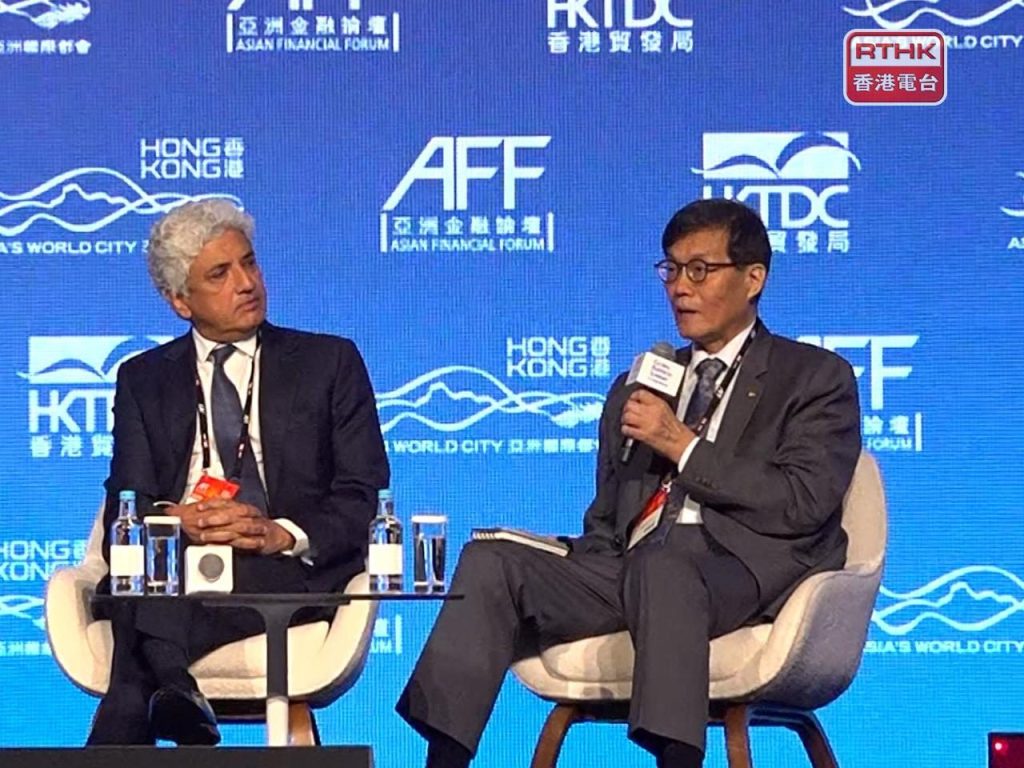

Talking on the Asian Monetary Discussion board in Hong Kong, Rhee emphasised that change fee volatility might set off fast shifts into USD stablecoins and enormous fund transfers.

The announcement comes as South Korean regulators stay deadlocked over complete stablecoin governance, with the Monetary Providers Fee and Financial institution of Korea break up on whether or not issuance ought to be restricted to bank-led consortia.

In the meantime, the received has confronted mounting strain from foreign money swings and Trump’s tariff threats, which pushed the change fee to 1,446.2 received per greenback on Monday.

Governor Flags Capital Management Issues Over Stablecoin Launch

Rhee careworn that after launched, won-denominated stablecoins “is perhaps used to avoid capital move management measures, particularly when mixed with US greenback stablecoins.”

He famous that USD stablecoins are broadly used and available, with transaction prices far decrease than utilizing {dollars} straight.

The governor warned that when change fee fluctuations set off market expectations, funds could move quickly into greenback stablecoins, resulting in large-scale money transfers.

He added that non-bank issuance of stablecoins makes regulation notably troublesome for authorities.

Regardless of these considerations, Rhee acknowledged that market strain has compelled authorities to permit South Korean residents to spend money on overseas-issued digital belongings.

He defined that won-denominated stablecoins would primarily serve cross-border transactions, whereas tokenized deposits would deal with extra home funds.

Gained Below Stress as Trump Tariff Menace Compounds Volatility

The won-dollar fee closed at 1,446.2 received on Monday, rising 5.6 received after President Donald Trump threatened to extend tariffs on Korean cars, lumber, and prescribed drugs to 25% from 15%.

Trump posted on Reality Social that the “South Korean’s legislature just isn’t residing as much as its take care of the USA,” asserting the tariff hike in response.

Nevertheless, the foreign money’s losses proved restricted as South Korea’s Nationwide Pension Service lowered its end-2026 international inventory goal to 37.2% from 38.9%, strengthening the received by as a lot as 2% to 1,433.3 per greenback following the announcement.

The welfare ministry stated greenback demand was growing with the pension fund’s rising measurement, whereas greenback provide within the onshore international change market was being outweighed by demand.

The KOSPI additionally rallied 2.73% to shut at 5,084.85 on Tuesday regardless of Trump’s tariff risk, as buyers purchased the dip following Samsung Electronics’ 4.87% acquire and SK Hynix’s 8.70% surge to a report excessive.

Min Kyung-won, a Woori Financial institution researcher, informed the ChosunBiz that Trump’s assertion “acts as a bearish issue for the received,” however added that the opportunity of coordinated market intervention by US and Japanese international change authorities helps the foreign money’s higher vary.

Regulatory Impasse Stalls Stablecoin Framework Regardless of Market Momentum

The Financial institution of Korea has pushed for stablecoins to be issued solely by consortia managed by banks, insisting that lenders maintain at the very least a 51% possession stake to guard financial stability.

The Monetary Providers Fee has resisted setting a hard and fast possession threshold, warning it might sideline know-how corporations and gradual innovation in digital funds.

Rhee emphasised on the Hong Kong discussion board that digital finance regulation ought to be strengthened, not relaxed, cautioning towards forgetting the prices of the 2008 monetary disaster.

He argued that South Korea’s quick cost system is extremely developed and retail CBDCs don’t provide vital benefits, although the central financial institution is conducting pilot tasks with tokenized deposits and wholesale CBDCs.

South Korea’s complete crypto legislation has been delayed to 2026 as a consequence of a dispute over who ought to be allowed to problem stablecoins.#Crypto #Regulationhttps://t.co/jKP9L9n63S

— Cryptonews.com (@cryptonews) December 30, 2025

The regulatory deadlock persists regardless of robust market momentum, as South Korea ended its nine-year company crypto buying and selling ban this month and handed amendments to the Capital Markets Act establishing authorized frameworks for tokenized securities buying and selling starting January 2027.

Again in October, the Solana Basis partnered with Wavebridge to develop a KRW-pegged stablecoin, whereas BDACS additionally launched KRW1 on Avalanche in September, with each token backed 1:1 by received held in escrow at Woori Financial institution.

The submit South Korea Eyes Home Crypto Issuance as Governor Warns on Stablecoin Dangers – What’s the Plan? appeared first on Cryptonews.