U.S. spot Bitcoin exchange-traded funds recorded a pointy reversal on December 30, pulling in $355 million in internet inflows and ending a seven-day stretch of persistent capital withdrawals.

The transfer marked the strongest each day influx since mid-December and got here after practically two weeks wherein ETF traders steadily diminished publicity as costs softened and year-end liquidity thinned.

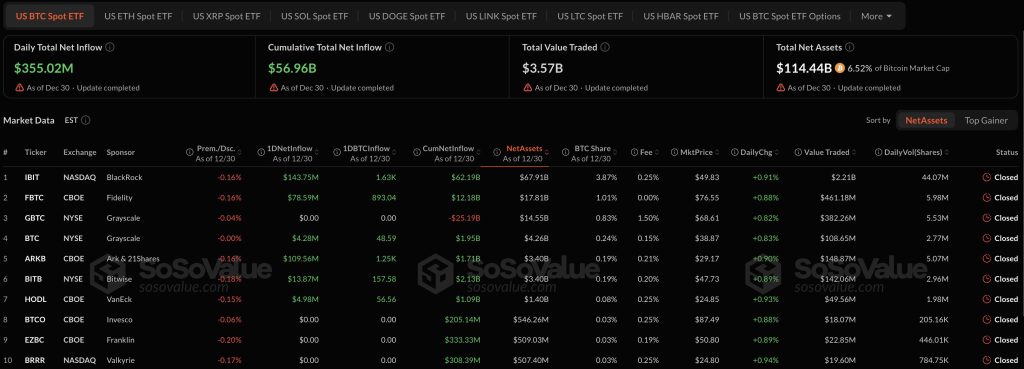

Sosovalue information exhibits that the rebound was led by BlackRock’s iShares Bitcoin Belief, which attracted $143.75 million in recent capital on the day.

ARK Make investments and 21Shares’ ARKB adopted with $109.56 million, whereas Constancy’s Clever Origin Bitcoin Fund added $78.59 million.

Smaller however nonetheless optimistic contributions got here from Bitwise, VanEck, and Grayscale’s legacy Bitcoin Belief.

The turnaround adopted a tough run wherein spot Bitcoin ETFs misplaced about $1.12 billion over seven buying and selling days, together with a heavy $275.9 million outflow on December 26, which stood out as essentially the most aggressive promoting session of the interval.

Bitcoin ETFs See December Losses, At the same time as Buying and selling Exercise Picks Up

December as an entire remained difficult for spot Bitcoin ETFs regardless of its late rebound, it has posted a internet month-to-month outflow of roughly $744 million, extending losses from November, when funds shed greater than $3.4 billion.

The stress was most seen between December 18 and December 29, when ETFs recorded outflows on seven of eight buying and selling days, briefly interrupted solely by a single giant influx on December 17.

Weekly information tells the same story, with two deeply unfavourable weeks previous the modest restoration seen within the last week of the month.

Even with the volatility, cumulative internet inflows throughout U.S. spot Bitcoin ETFs nonetheless stand at $56.96 billion, underscoring the dimensions of institutional participation constructed up earlier within the yr.

Complete internet property held by these merchandise reached $114.44 billion as of December 30, representing about 6.52% of Bitcoin’s complete market capitalization.

Buying and selling exercise additionally picked up alongside the rebound, with complete worth traded throughout Bitcoin ETFs reaching $3.57 billion for the day.

Flows remained closely concentrated among the many largest issuers. BlackRock’s IBIT continues to dominate the market, with cumulative internet inflows of $62.19 billion and practically $68 billion in property underneath administration, equal to roughly 3.9% of Bitcoin’s circulating provide.

Constancy and ARK 21Shares adopted at a distance, whereas Grayscale’s GBTC continued to point out no recent inflows and stays deeply unfavourable on a cumulative foundation as a consequence of long-running redemptions after its conversion from a belief construction.

Bitcoin Consolidates Beneath $90K Whereas Ethereum ETFs Keep Regular

The shift in ETF flows got here as Bitcoin costs stabilized after a unstable intraday cycle. Bitcoin was buying and selling close to $88,800 on the time of the newest information, up modestly over 24 hours however nonetheless nicely under its all-time excessive.

Worth motion over latest classes confirmed a pointy transfer towards the $90,000 degree, adopted by a rejection and pullback towards the mid-$86,000 vary, the place consumers stepped in and halted additional declines.

Since then, the market has moved sideways, with worth oscillating between established assist close to $86,700 and resistance round $88,000, reflecting a pause as merchants reassess path.

Ethereum spot ETFs confirmed steadier circumstances by comparability as On December 30, ETH-linked ETFs recorded $67.84 million in internet inflows, lifting cumulative inflows to $12.40 billion.

Complete internet property stood at just below $18 billion, representing about 5% of Ethereum’s market capitalization.

BlackRock’s ETHA stays the most important product by property, whereas Grayscale’s ETHE accounted for the majority of the day’s inflows regardless of nonetheless carrying a unfavourable cumulative steadiness tied to earlier redemptions.

The put up Spot Bitcoin ETFs Pull In $355M, Ending 7- Day Bleed — Is Liquidity Lastly Turning? appeared first on Cryptonews.