The Australian Bitcoin Business Physique has filed a proper criticism with the Australian Broadcasting Company over what it calls “factually inaccurate and deceptive” protection of Bitcoin, escalating tensions between the nation’s rising crypto sector and conventional media.

The criticism targets an ABC article that portrayed Bitcoin primarily as a automobile for cash laundering whereas ignoring documented use instances in power stabilization, humanitarian remittances, and sovereign reserves.

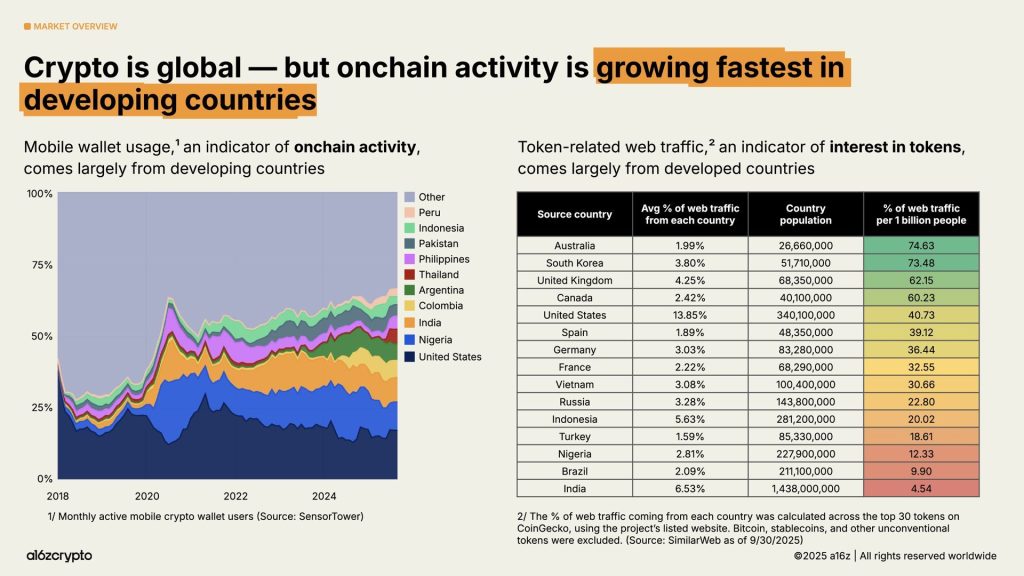

The transfer comes as Australia’s crypto adoption fee outpaced even the US, reaching 31% in 2025, up from 28% in 2024, putting the nation among the many world’s most crypto-engaged populations based on a16z’s State of Crypto 2025 report.

ABIB stated it receives frequent contact from pissed off members concerning recurring misrepresentation of Bitcoin in Australian media, notably from publicly funded establishments required by statute to supply correct journalism.

Business Physique Cites A number of Coverage Breaches

ABIB’s submission identifies particular sentences that it alleges breach the broadcaster’s editorial insurance policies and code of conduct.

The criticism facilities on one-sided framing that conflates Bitcoin with prison exercise whereas omitting publicly out there details about reputable functions.

The ABC article, written by chief enterprise correspondent Ian Verrender, characterised Bitcoin as having “no helpful objective” and described cash laundering as its “final helpful enterprise.”

The piece targeted on Bitcoin’s worth volatility, dropping from $126,000 to beneath $90,000, whereas emphasizing the cryptocurrency’s alleged failures.

ABIB countered that the protection decreased Bitcoin to outdated tropes targeted on worth swings and U.S. politics, calling on ABC to difficulty corrections and interact subject-matter experience in future reporting.

The Australian Bitcoin Business Physique (ABIB) has lodged a proper criticism with the Australian Broadcasting Company (@abcnews) concerning its current article on Bitcoin.

The piece contained a number of factual errors, deceptive claims, and one-sided framing that breach the ABC’s…— Australian Bitcoin Business Physique (@AusBTCIndBody) December 2, 2025

Criticism Arrives Amid Regulatory Transformation

The dispute arises amid important regulatory evolution in Australia’s digital asset sector.

In November, Treasurer Jim Chalmers and Monetary Providers Minister Daniel Mulino launched the Companies Modification (Digital Property Framework) Invoice 2025, establishing the nation’s first complete regulatory framework for corporations holding crypto on behalf of consumers.

The ministers stated they “take Australia’s crypto business significantly,” including that blockchain and digital belongings current “huge alternatives for our financial system, our monetary sector, and our companies.”

The federal government’s reforms may unlock $24 billion in annual productiveness beneficial properties whereas strengthening safeguards for Australians entrusting their digital belongings to personal platforms.

Australia has launched its first full regulatory framework for crypto custody and change platforms that guarantees more durable oversight.#Australia #Cryptohttps://t.co/jzYWZ9Vk6I

— Cryptonews.com (@cryptonews) November 27, 2025

Underneath the invoice, crypto exchanges and custody suppliers should acquire an Australian Monetary Providers License, bringing them below ASIC supervision.

The framework introduces two new license classes. A digital asset platform and tokenized custody platform, with licensed companies required to adjust to ASIC requirements for transactions, settlement processes, and asset custody.

Regulators Stability Innovation With Safety

ASIC has additionally clarified digital asset regulation whereas supporting business growth.

In October, the regulator declared stablecoins, wrapped tokens, tokenized securities, and digital asset wallets to be monetary merchandise below present regulation, requiring service suppliers to acquire licenses whereas granting an eight-month transition interval by June 30, 2026.

ASIC Commissioner Alan Kirkland stated, “Distributed ledger expertise and tokenization are reshaping world finance,” and that the steering supplies regulatory readability, enabling companies to innovate confidently.

Actually, ASIC Chair Joe Longo warned that Australia dangers falling behind as blockchain-driven tokenization reshapes world markets, cautioning that until Australia adapts, it may grow to be a “land of missed alternative.“

He famous that J.P. Morgan advised him their cash market funds might be completely tokenized inside two years.

Australia should "seize the chance or be left behind" as tokenization transforms capital markets, warns @ASIC_Connect Chair Joe Longo.#Australia #Tokenization #ASIChttps://t.co/gbJI1uAzb6

— Cryptonews.com (@cryptonews) November 7, 2025

Australia’s institutional crypto engagement has accelerated considerably, with self-managed superannuation funds accounting for 1 / 4 of the pension system and crypto publicity leaping sevenfold since 2021 to A$1.7 billion.

The rising adoption has attracted main gamers, with Coinbase making ready to launch a devoted SMSF service with over 500 buyers on its ready listing, focusing on the nation’s pension pool, whereas OKX launched the same product in June that exceeded expectations.

The regulatory framework consists of an 18-month grace interval earlier than licensing guidelines take impact.

Small operators dealing with lower than A$10 million in annual transaction quantity might be exempt.

For individuals who may go towards the rule, earlier laws has proposed penalties of as much as 10% of annual turnover for platforms breaching guidelines, with companies going through fines of A$16.5 million, thrice the profit gained, or 10% of annual turnover for deceptive conduct.

The publish Crypto Business Information Criticism Towards Australia’s ABC Over Bitcoin Article appeared first on Cryptonews.